As a Salesforce partner ShellBlack has seen many products based on the platform over the years and one of the most successful to date has been Financial Services Cloud (FSC). Financial companies of all types are seeing the value of Salesforce, particularly with a solution tailored to their needs. Part of the value FSC offers is its core functionality for managing Clients and Households. The key to leveraging this functionality is getting your potential new Clients and Households created in the proper data structure quickly and easily. It’s important to note that FSC uses two data model options for Client Accounts – Person Accounts and Individual Accounts. For purposes of keeping things simple we will be focusing on the Person Account Record Type.

Natively, lead conversion is the best option to create Client Accounts as it requires no code and minimal configuration. The most important aspect of lead conversion is the creation of Person Accounts – which are actually two different records mashed-up to appear as a single record. With lead conversion, these two records are created and properly associated, which is essential for managing the Client in FSC. This native capability for creating a Client Account is a fairly easy process to stand up and for end-users to adopt.

Here is an overview of the lead conversion process:

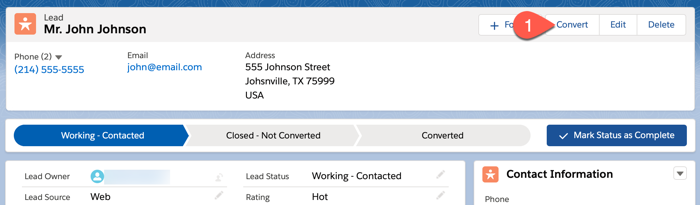

Figure 1 – Start by clicking “Convert”

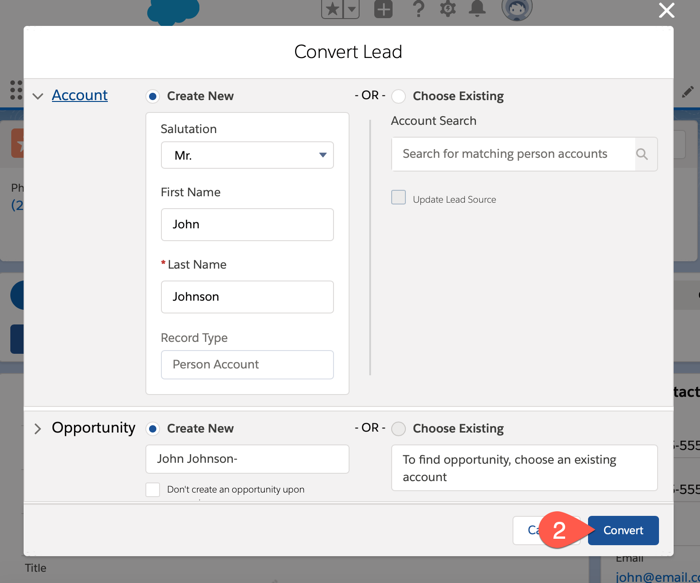

Figure 2 – Lead conversion preview

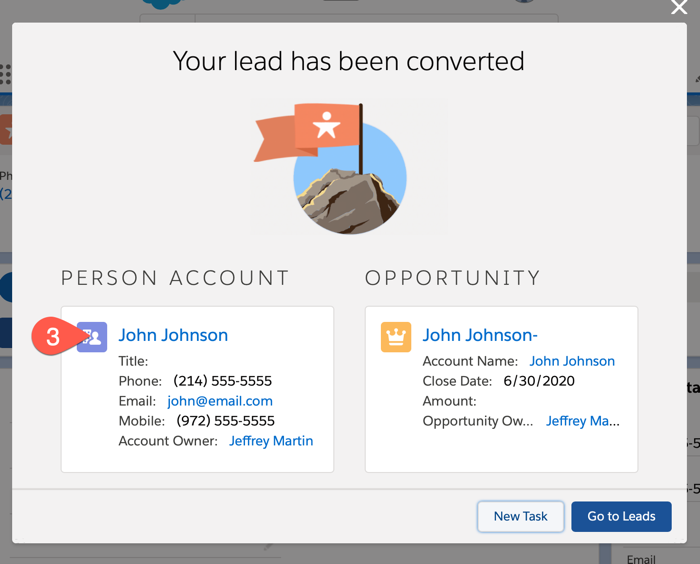

Figure 3 – Lead successfully converted

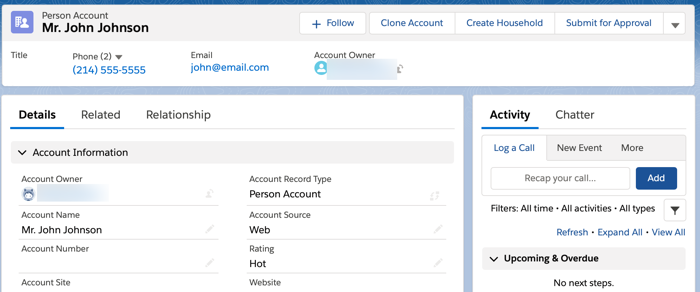

Figure 4 – New Client record

What comes next is creating the Household record and associating it with the Client record [Person Account]. This Household step is critical for most financial services companies, but it’s also one of the more challenging for end-users to perform correctly. The impact is a slow down in the Client setup process, end-user frustration, and data quality issues. To address this gap there are two accelerators, one paid and one free, that will speed up the process and ensure your data quality remains high.

The accelerators are:

- ShellBlack Household Automation Accelerator

- Salesforce Labs “Lead Conversion for Financial Services Cloud”

Each is independent of the other and can be used separately, or you can use them together. We’ll demonstrate the efficiencies of both tools, how they are different, and why they work well together.

The ShellBlack Household Automation Accelerator

Based on the ShellBlack design philosophy, we leverage native functionality to the greatest extent possible, while creating custom solutions that add value. The same is true for the Household Automation Accelerator – it uses native Lead conversion functionality to create the Client Account record. From the Client Account record the Household Automation accelerator offers four key features:

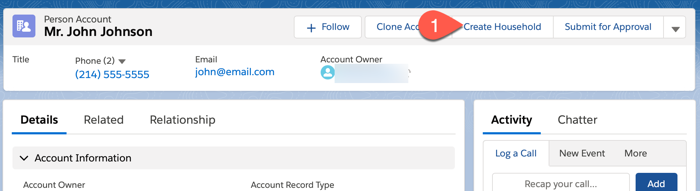

FEATURE NO.1: Easily create a Household Account record

Figure 5 – Open the Create Household screen

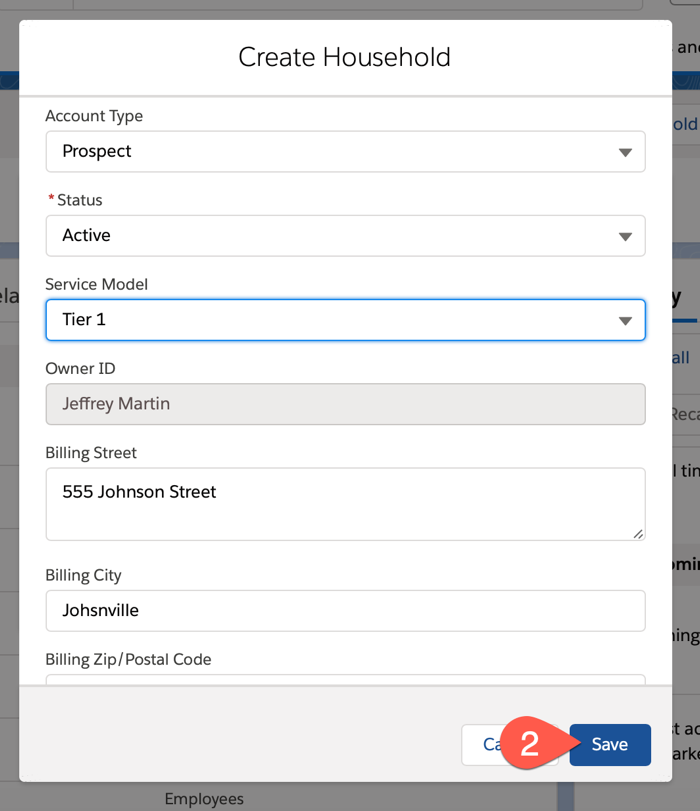

Figure 6 – The fields on the Create Household screen are customizable

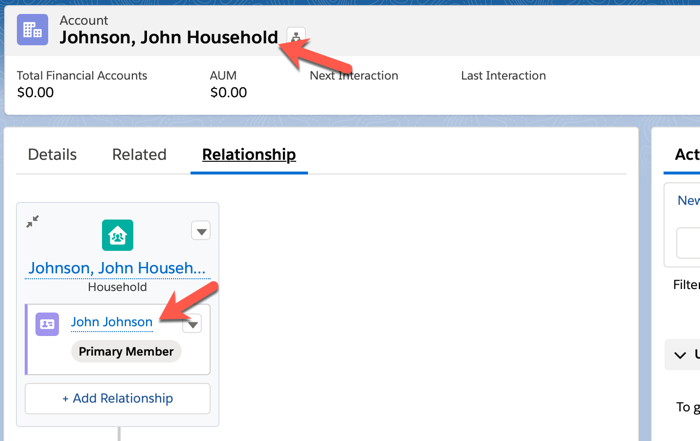

FEATURE NO.2: Automatic association of the Client record to the Household

Figure 7 – The Household is created with the Client record associated

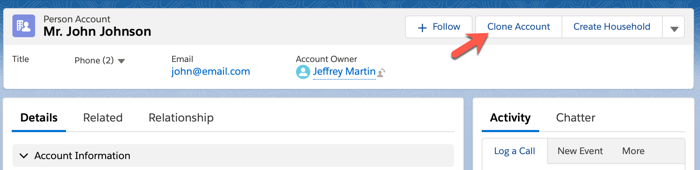

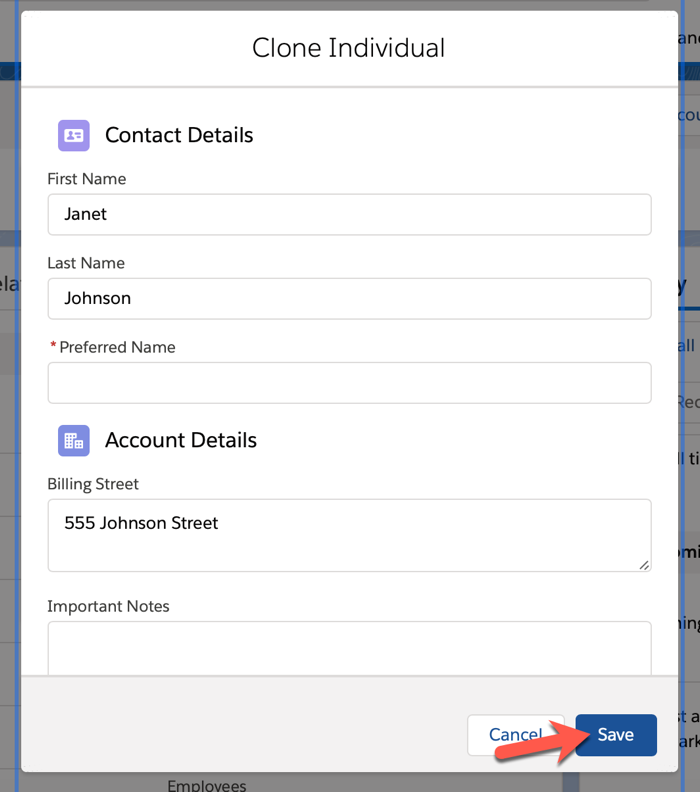

FEATURE NO. 3: Easily create additional Client records under the Household

Figure 8 – Additional Clients under the same Household can be easily created

Figure 9 – The Clone Account screen fields are customizable

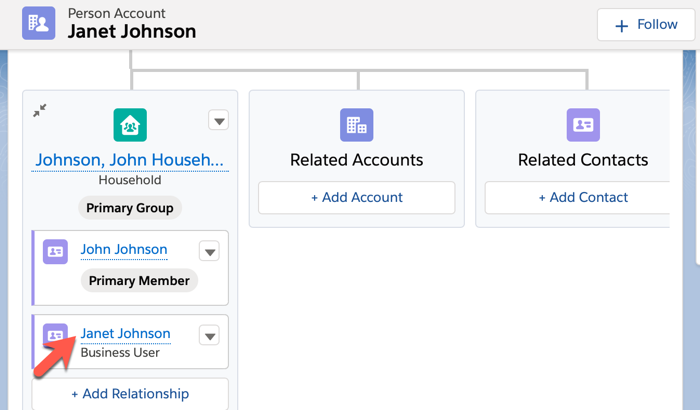

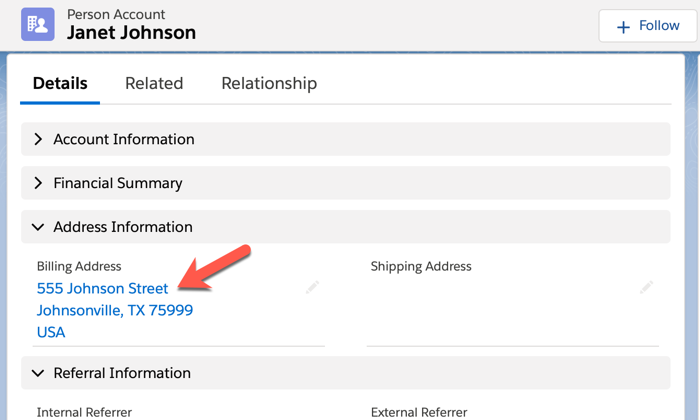

Figure 10 – The new Client is created and also associated with the Household

FEATURE NO. 4: Automatic field syncing among all the Clients under a Household

Figure 11 – Select the fields you want to keep in sync across all Clients under a Household

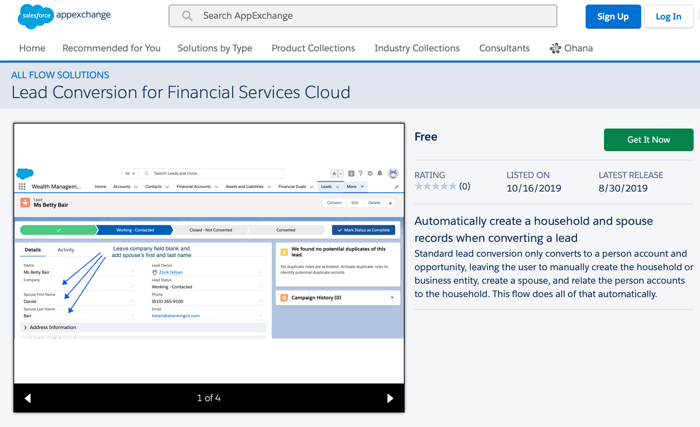

The Salesforce Labs “Lead Conversion for Financial Services Cloud” AppExchange listing

The Lead Conversion for Financial Services Cloud from Salesforce Labs has similar functionality to the ShellBlack Household Accelerator. It also automates the lead conversion process by allowing you to create a client account, a spouse account, and Household Account, while properly associating the records. However, it does not keep records in sync after they have been created.

Lead Conversion for Financial Services Cloud from Salesforce Labs

Both tools significantly increase process efficiency and improve data quality, but do they work well together? Yes! If you want to automate the Lead conversion process, the Salesforce Labs Lead Conversion for Financial Services Cloud works well with the ShellBlack Household Automation Accelerator. The Salesforce Labs App, during lead conversion, will create your Client, a spouse, and properly associate them to a Household. After that the ShellBlack Household Automation Accelerator will allow you to create and properly associate additional Client records under the Household, while keeping your key native and custom fields in sync. Both are great options to consider depending on your business process.

If you are interested in the ShellBlack Household Automation Accelerator or assistance with Financial Services Cloud, contact us today!

Author Credit: Jeff Martin is the Vice President of Delivery at ShellBlack