The TD Ameritrade Institutional Editions of Salesforce are being sunsetted. In other words, TD Ameritrade and Schwab will no longer maintain or support these legacy CRMs. If you are a wealth management firm using one of the TD Ameritrade Institutional Editions of Salesforce, you should have received an email from Schwab regarding your CRM. You should also know that the clock is ticking to weigh your options. The bulk of technology will be merged between the two organizations as of Labor Day 2023. While you won’t lose access to your Salesforce CRM or data on that date, some integrations may be impacted.

So what are your options?

- Maintain your current version of Salesforce by moving your contract from Schwab to Salesforce.

- Upgrade to Financial Services Cloud (FSC).

- Migrate to another CRM.

Let’s look at the pros and cons of each option.

Option 1: Keep your existing version of Salesforce

Pros

- The only effort required is working with Salesforce to execute a new agreement.

- You are able to continue using your current CRM.

Cons

- Your CRM will not receive any additional enhancements, new features, or upgrades from Schwab. You will be on your own to maintain or add new functionality. Unless you have a very skilled Salesforce Administrator on staff, you will need to engage a Salesforce partner like ShellBlack to update your CRM as your business evolves.

- You may need to find new integration options for tasks such as keeping financial account information up-to-date in Salesforce.

Option 2: Migrate to FSC

Pros

- You will be on the latest industry solution from Salesforce. This is the best option to “future-proof” your CRM.

- Using Schwab’s new connector for FSC, you can continue to receive updated financial account information. Multiple connectors are available for FSC, depending on your custodian relationships. This approach offers a fresh start. Simply leave the technical debt of your old Salesforce CRM behind.

Cons

- This option requires a full FSC implementation, including setup, configuration, and training — along with data migration. Depending on the size of your firm and the complexity of your business processes, this can be a significant investment. At a minimum, the migration process takes eight weeks — so plan ahead! A Salesforce partner like ShellBlack can provide you with a more accurate timeline and cost estimate.

Option 3: Move to another CRM

Pros

- As with Option 2, this is another fresh-start approach that eliminates any negative aspects of your old Salesforce CRM.

Cons

- You will need to spend time researching and evaluating CRMs to find one that meets your business requirements.

- There will likely be costs involved to configure the new CRM, migrate your data, train your users, and add third-party applications.

As a proven Salesforce partner with targeted expertise in wealth management, ShellBlack is happy to offer our perspectives to help answer the following frequently asked questions about migrating to FSC.

FAQs

How do I get a demo of or learn more about FSC? Contact us, and we’ll connect you with the right person at Schwab, who will ultimately relay your information to Salesforce.

How do I get pricing from Salesforce if I want to move to FSC? Contact us, and we’ll connect you with the right person at Schwab, who will ultimately relay your information to Salesforce.

Can I move to FSC on my own? From our experience, no — at least not successfully. Even if you have a System Administrator on staff, it is unlikely that they will have the specialized knowledge to make a seamless move. For example, one of the big missteps that we see repeatedly is data imported incorrectly, causing a chain reaction of issues.

How do I get implementation costs on migrating to FSC? Contact us, and we can provide you with an estimate.

What factors drive the implementation costs to move to FSC? The big driving factors are the amount of data to be moved and the complexity of your business processes. For example, a five-person team typically has fewer custom business processes and less data than a 100-person firm.

How much time is involved to move to FSC? Small firms can typically migrate in about eight weeks. Larger firms may need several months to migrate. We can provide a more accurate estimate after a discussion with you.

My contract ends next month. Is there time to move to FSC? No. The minimum window to make a migration once your project begins is eight weeks.

My contract with TD Ameritrade does not expire until next year. Do I need to do anything now? No immediate action is required, but it’s a good idea to at least get pricing and a better idea of lead time. A migration to FSC is probably not something you want to tackle at the end of year or during tax season, for example.

Do I need training if I move to FSC? Yes. At a minimum, we recommend an orientation to new features and the data model, which is very different from your current CRM. Most firms prefer “Day in the Life” training, which covers the main activities they’re likely to perform managing their clients.

What should my team expect during the migration process? How much of a burden will it be? You will need a small dedicated project team on your side. Subject Matter Experts (SMEs) will be needed to provide ShellBlack with accurate business requirements. You’ll also need staff to participate in user acceptance testing, data mapping, and validation. Plan on one to two meetings a week for the duration of the project.

I have solutions from the AppExchange and other third-party vendors. Will they continue to work? Possibly. We can help you determine if they work with FSC, or if there are alternative solutions.

How do I find out more about the new Schwab connector for FSC? Read more here: Schwab app to integrate with Salesforce Financial Services Cloud.

Can any Salesforce partner implement FSC? Salesforce FSC is a bespoke and highly specialized solution, so you probably do not want a Salesforce partner trying to learn FSC on your dime. The data model is unique, with lots of custom functionality. ShellBlack has gained in-depth knowledge from completing hundreds of FSC implementations since 2015.

Can I migrate all my information to FSC? Yes. ShellBlack can move your data, files, notes, attachments, and activities.

Are there any items that cannot be migrated to the new org? Reports and dashboards, workflows and automation, and custom code must be re-created in the new FSC org. There is also the possibility of legacy third-party applications not working with FSC.

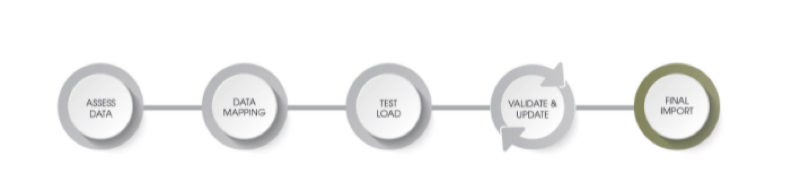

How does ShellBlack migrate my data? We follow a multistep process to ensure your data migration success.

Take a deeper dive into our process by reading our previous blog Financial Services Cloud: Data Migration Considerations. We walk through each of the steps in detail.

What are my next steps if I want to migrate to FSC? ShellBlack is ready to step in to provide the expert support you need. As a tenured and trusted consulting partner since 2010, we are experienced in migrating data from various platforms, including Salesforce to Salesforce. We have worked with more than 330 wealth firms to date. ShellBlack is also listed on the Charles Schwab site as a Salesforce consulting service vendor.

If you’re ready to explore CRM management solutions to keep your financial advisory services up to date, contact us at shellblack.com/Schwab.