This blog post combines key takeaways from two sessions conducted by RBC Wealth Management at Dreamforce 2024: “How RBC Uses Einstein and Model Builder to Safely Deploy AI” and “Enhancing Wealth Advisors with AI & Strategic Partners.”

In recent years, RBC Wealth Management has emerged as a forerunner for Salesforce to demonstrate the art of the possible with Financial Services Cloud (FSC) and the rest of the Salesforce tech stack. Dreamforce 2024 was no exception, as RBC tackled one of the most frequently requested use cases among ShellBlack wealth clients — how to handle meeting preparation using artificial intelligence (AI) to leverage Household account data within Salesforce FSC.

The Problem with Meeting Prep

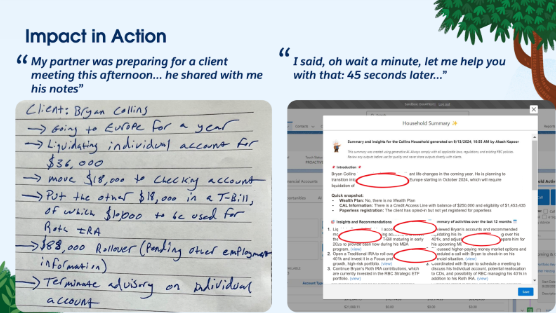

The phrase “meeting prep” seems straightforward, until you consider what’s involved. Let’s say an advisor needs to conduct an annual review with one of the firm’s biggest and most complex clients. The information that needs to be compiled can be scattered everywhere — in Salesforce, a portfolio management system, planning software (think MoneyGuide Pro or eMoney), emails, and even on paper. To cull through a year’s worth of client interactions can take multiple people and hours of time. That information then needs to be summarized, with action items identified, open and completed tasks inventoried, and so on.

Why RBC Starts with the Financial Services Cloud Household Summary

At RBC, advisor compensation was the company’s biggest expense — and the time and manual effort that advisors and staff spent on meeting prep was enormous. It was clear that the greatest opportunity for a strong return on investment was to focus on advisor productivity.

Even though much of the data was in Salesforce, it was still challenging to summarize. For example, have you ever tried to write a report on activities that have occurred on a Household since the last annual client meeting? It’s not easy. It’s a huge ask to have an advisor comb through a year’s worth of interactions to find what’s relevant.

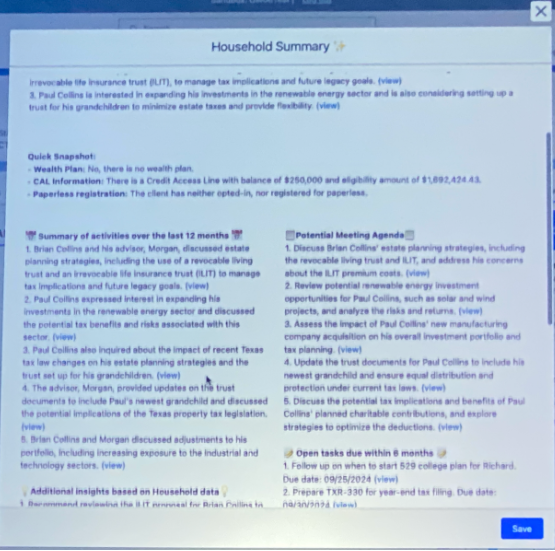

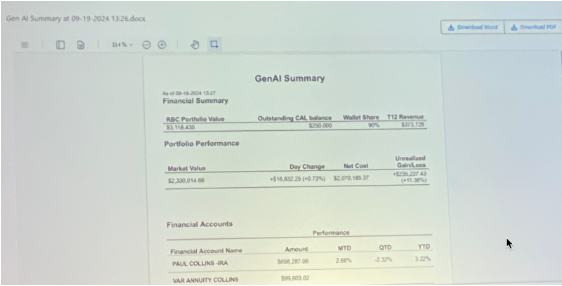

The good news for RBC was that the firm already had the data foundation to solve this use case using generative AI. Since all the data and metadata was in Salesforce and Data Cloud, it worked, and the responses were tightly focused and accurate. With AI, they can have a Household Summary in minutes, along with notes and action items for advisors. The true amount of time will vary depending on the breadth and complexity of the data related to the Household, but one to two minutes is a common range.

If you look at the side-by-side comparison below, generative AI got the same results as an advisor, and even the same numbers!

So How Does It Work?

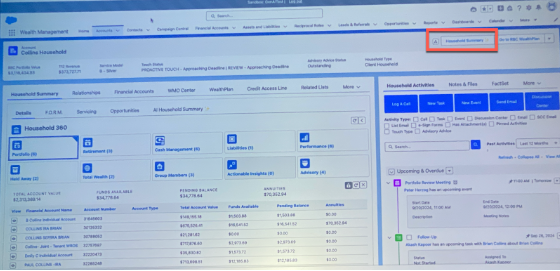

It starts with a Household Summary button (see red box) on the Household record.

When you look at the Household Summary that is generated, note the blue “View” links. Those are the attributions back to the originating record. This helps users to feel confident about the data and to check for AI hallucinations.

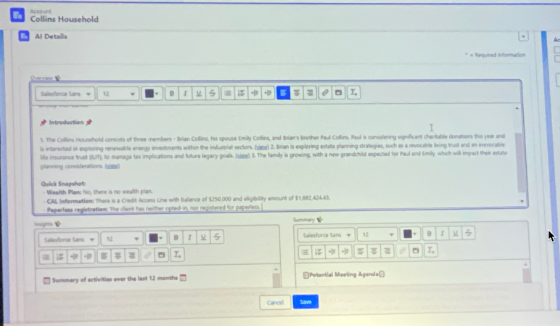

Each time a Household Summary is generated, a corresponding record is created. This allows users to edit the summary or make corrections as they see fit using OmniScript.

The Household Summary within Salesforce FSC can be easily exported to a print-friendly Word document or PDF. This can be a valuable tool for advisors who want to be able to walk into a client meeting with a hard copy and take notes in the margins.

What Was the Investment of Time and Effort?

RBC started talking with Salesforce Professional Services representatives and a consulting team with McKinsey right after Dreamforce 2023. The solution that was shown at Dreamforce 2024 was the result of 14 weeks of refinement — yet it’s important to note that RBC had a working demo within six weeks. At the outset, the Household Summary took two and half minutes to generate. Since then, RBC has been fine-tuning the organization and readability of the information presented. Based on feedback from 25 pilot advisors and support staff, another eight to 10 weeks of adjustments were recommended.

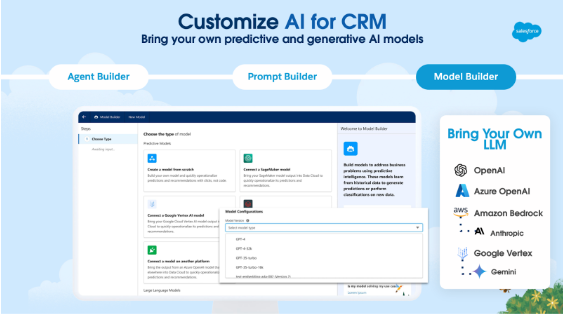

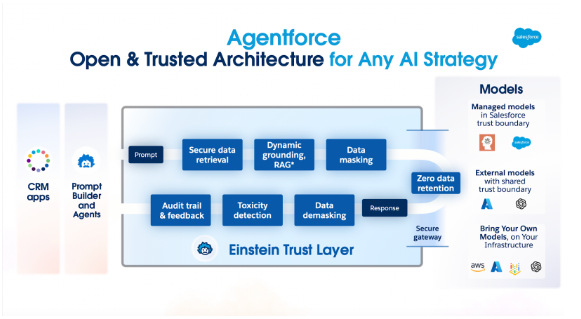

Keeping Your LLM Within the Trust Layer

These Dreamforce sessions emphasized the value of having Salesforce FSC host your large language models (LLMs) so that your queries never leave the Salesforce Trust Layer.

RBC is using the Managed model as seen in the slide below. They are leveraging Anthropic, Bedrock, and AWS. They thought Anthropic summarized data closer to the voice of an advisor than other LLMs.

Having RBC’s data never leave the control of Salesforce was an absolute requirement. Even with Salesforce’s Trust Layer, Zero Copy data retention, and data masking, RBC was adamant that the solution should be hosted by Salesforce, rather than being sent to a public LLM, as an added layer of protection to keep personally identifiable information (PII) secure.

What’s Next on RBC’s Road Map?

Internal Use Cases:

The next internal use case for RBC might be pipeline management. Advisors don’t like typing data into Opportunities, but it drives revenue. They see service as an opportunity as well because of all the existing knowledge information they can leverage. Incorporating external data (e.g. positions, transactions, and performance data) could also be an option.

External Use Cases:

The client side could be ripe for another use case. With a limited number of advisors serving so many clients, there is a lot of value left to unlock in terms of advisor productivity. That being said, RBC acknowledges the need for more regulatory guidance before using generative AI with clients. Since Salesforce says Agentforce is 95% accurate, that may not be good enough for a regulated industry.

Parting Thoughts from RBC

Start with a strategy. For wealth firms that are contemplating a move to AI to help address common use cases, the RBC team echoed a theme that was prevalent throughout Dreamforce 2024: Don’t launch the technology just for technology’s sake. Instead, take the time to develop a data strategy to outline the value you hope to achieve, while keeping trust and compliance at the forefront.

Be patient. AI technology and its role in FSC is changing all the time. RBC considers its multiweek investment to streamline Household Summaries to be time well spent. They also expect the next use case will be faster to develop.

Don’t discount the importance of change management. For RBC advisors, their “aha moment” came when they saw what was included and what was missing from the Household Summary. They instantly saw the value of keeping data clean and up-to-date in Salesforce. Without the data captured in Salesforce, and in the right place, generative AI can only do so much. RBC has a dedicated team to shepherd change management and fill in the gaps.

Contact ShellBlack to Leverage AI for FSC

To learn more about Salesforce FSC, Agentforce, Household Summaries or other AI solutions, contact us.

You can also read more about Dreamforce 2024 AI use cases for FINs in our blog: Dreamforce 2024 Notes: AI Agents Are Here for Your Success

Author credit: Shell Black, President & Founder at ShellBlack