Financial advisors who rise above the crowd are the ones who develop amazing, consistent experiences for their clients. These advisors make it their mission to ensure that each client enjoys the same exceptional level of service and attention — every time, from every advisor. Each time a client calls for service or comes in for a meeting, there are several steps in the process that the team must complete in a logical order to meet that client’s needs and deliver a consistent experience in a timely manner. Some of the tasks are quite simple, but with so many priorities in your busy office, they can sometimes slip through the cracks without the right process in place. In a prior blog article, we discussed using Salesforce cases to automate service requests such as address changes or the death of a client. In this blog, we discuss using Action Plans to automate a complete sales process that could include client onboarding, financial planning, or a new investment sale.

Action Plans in Salesforce Financial Services Cloud allow you to capture repeatable tasks that are automatically assigned, with deadlines, to team members. This helps your firm deliver consistent, and compliant, client engagements. Action Plans can be customized with your processes to ensure that all the steps you’ve defined in your processes are followed.

Set Up Action Plans

Before you start developing your action plan, your Salesforce administrator will need to activate Action Plans. This involves setting up profiles, assigning permission sets, and adding select components to the page layout. Business hours need to be defined so that Action Plans will avoid non-working hours and holidays for deadline calculation and task completion. Your administrator will set up account teams and roles so that a role can be assigned to each Action Plan task. The account team can work together seamlessly on Action Plans for your clients.

Make a Template

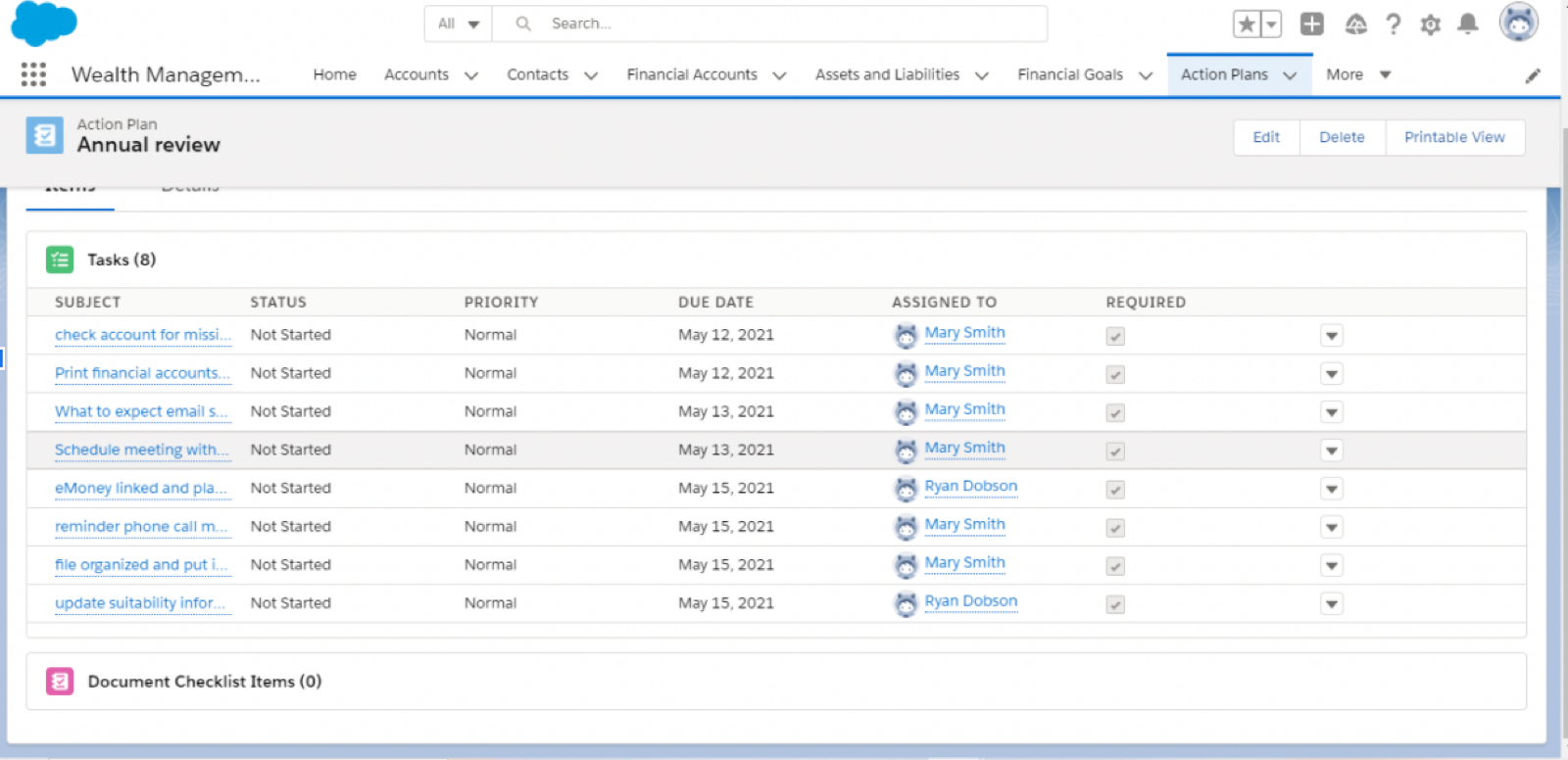

Once all the setup is done, you’re ready to tackle an Action Plan. As an example, let’s create one for your annual review meeting. The first step is to make a template of the repeatable process that makes up your annual meeting review.

Each step of your annual meeting review is entered as a task on the template. You can assign a priority to that step, assign it to a role or a person, establish how many days it should take to complete, and specify whether it’s required or optional.

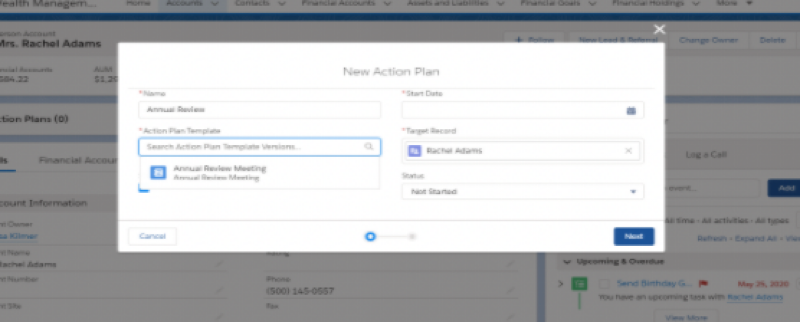

Let’s go to a client account page and create an annual review meeting for our client Rachel Adams. Action Plan has been added to our page layout, so click on New Plan, then name it and select Annual Review Meeting as the template. Choose the Start Date and Status from the picklist.

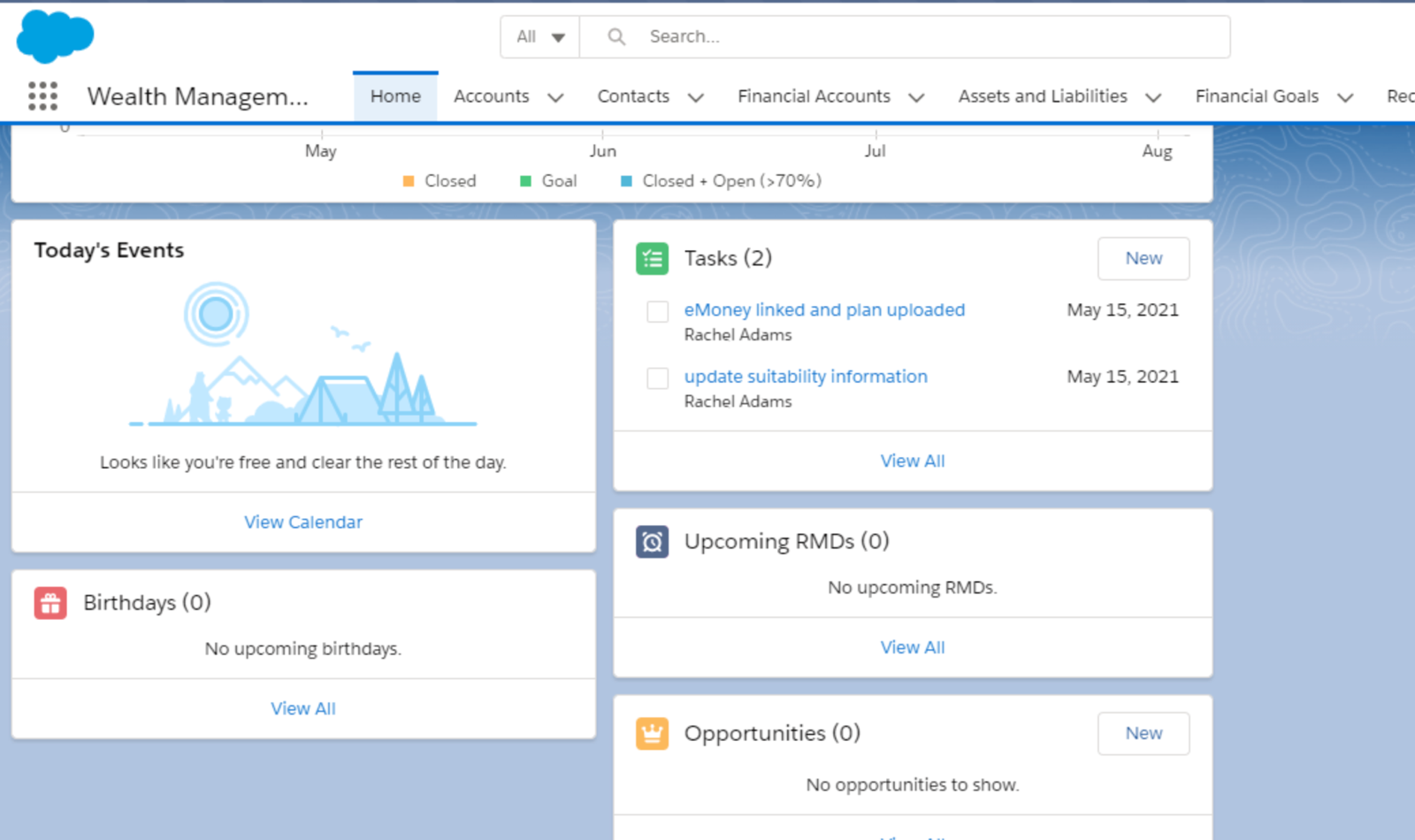

These tasks have been assigned to team members. The tasks show up on their screens in Salesforce as tasks to be completed, including the dates they are due. Ryan was assigned two of the tasks, both due May 15, as seen below on Ryan’s home screen.

In this example, you’ve delegated the steps to prepare for your annual review meeting, and everyone knows their tasks and deadlines for completion. Templates can be set up for repeatable meetings, service requests, client onboarding, opening new accounts, or any other process that relies on team members to follow the same steps each time to deliver a consistent experience.

Next Level Action Plans

The previous example leverages the basic functionality of Action Plans. Consultants at ShellBlack have taken Action Plans to the next level by using them as components in a much larger automation of your sales processes. Flow Automation lets us link these processes together:

- The first client meeting

- The financial planning stage

- Selling a life insurance policy

- Rolling over an investment

- Sending the Thank You card

Each of these is a defined, repeatable process that has tasks to be completed for each step.

Let’s walk through the Sales Process of an imaginary wealth management firm named ABC Financial. Their process starts with an initial client meeting to meet and get to know their new lead, Joe. Joe receives the introductory email sent by ABC Financial after he schedules his appointment. This automated task lets him know what will happen in this meeting and what he needs to bring. It also includes a video to introduce the team! Joe really appreciates all the information so he knows what to expect.

Their process includes a financial plan that they create for every new client. The first set of linked Action Plans is a set of four meetings. Each meeting has required tasks that are assigned to staff or advisors.

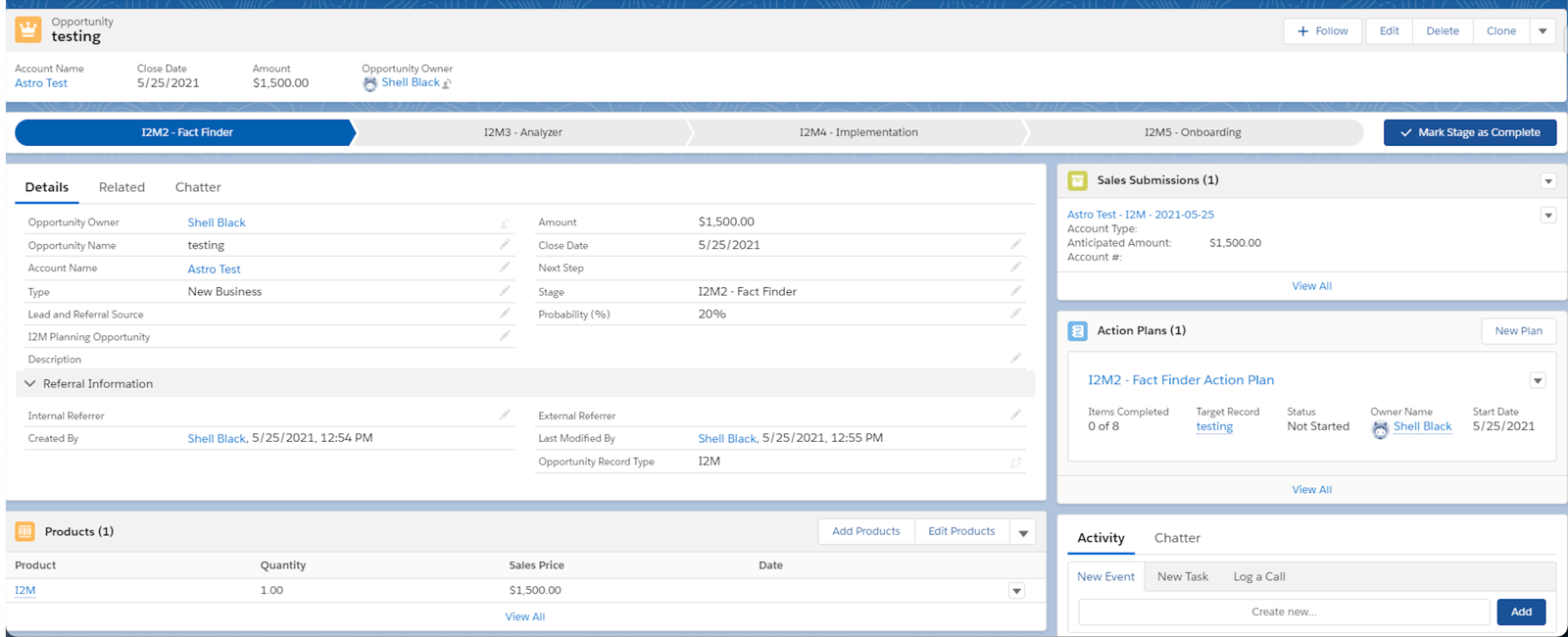

The first two meetings involve fact finding and delivering the plan to the client. If the client decides that they want to move forward with the advice in their financial plan, the highlighted step on the path moves to the Implementation stage and to Onboarding to gather any additional information that will be needed going forward.

We automatically move to the next connected flow opportunity.

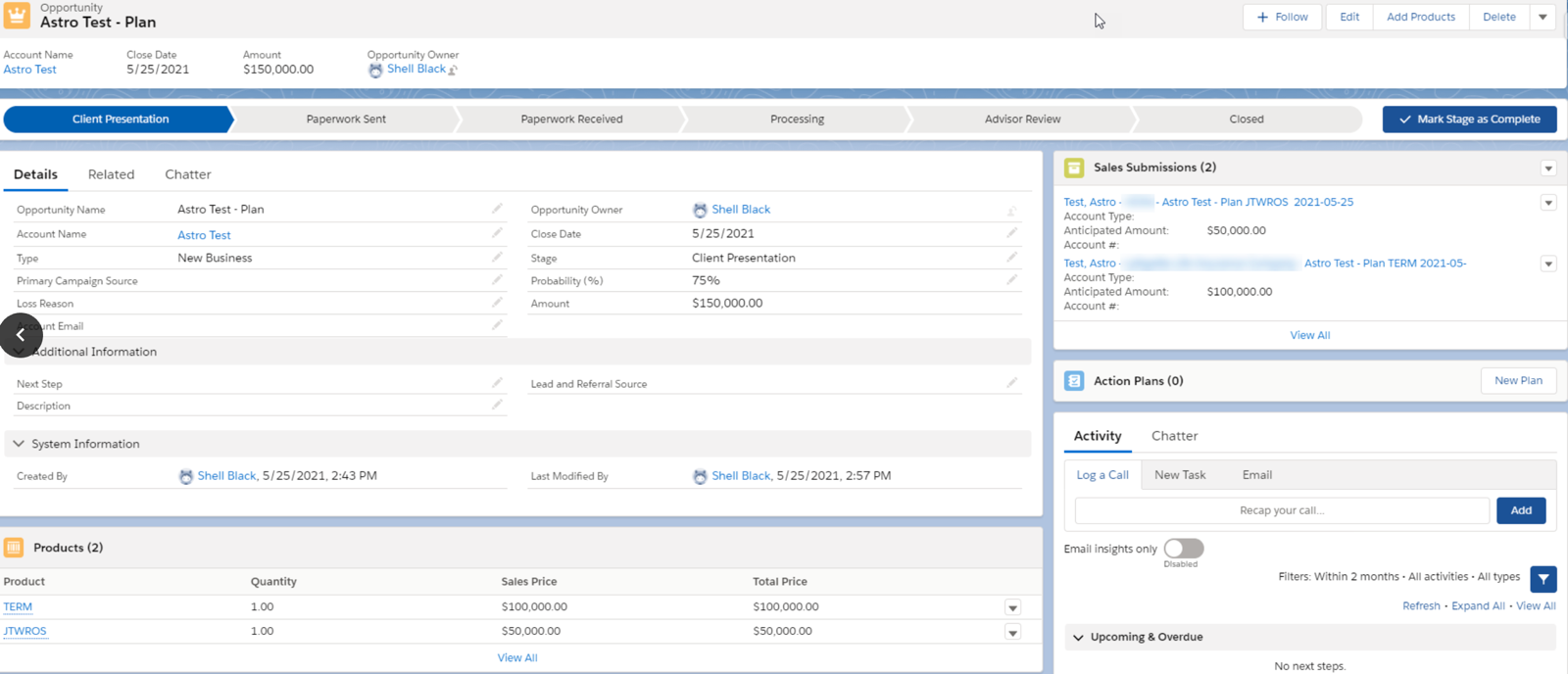

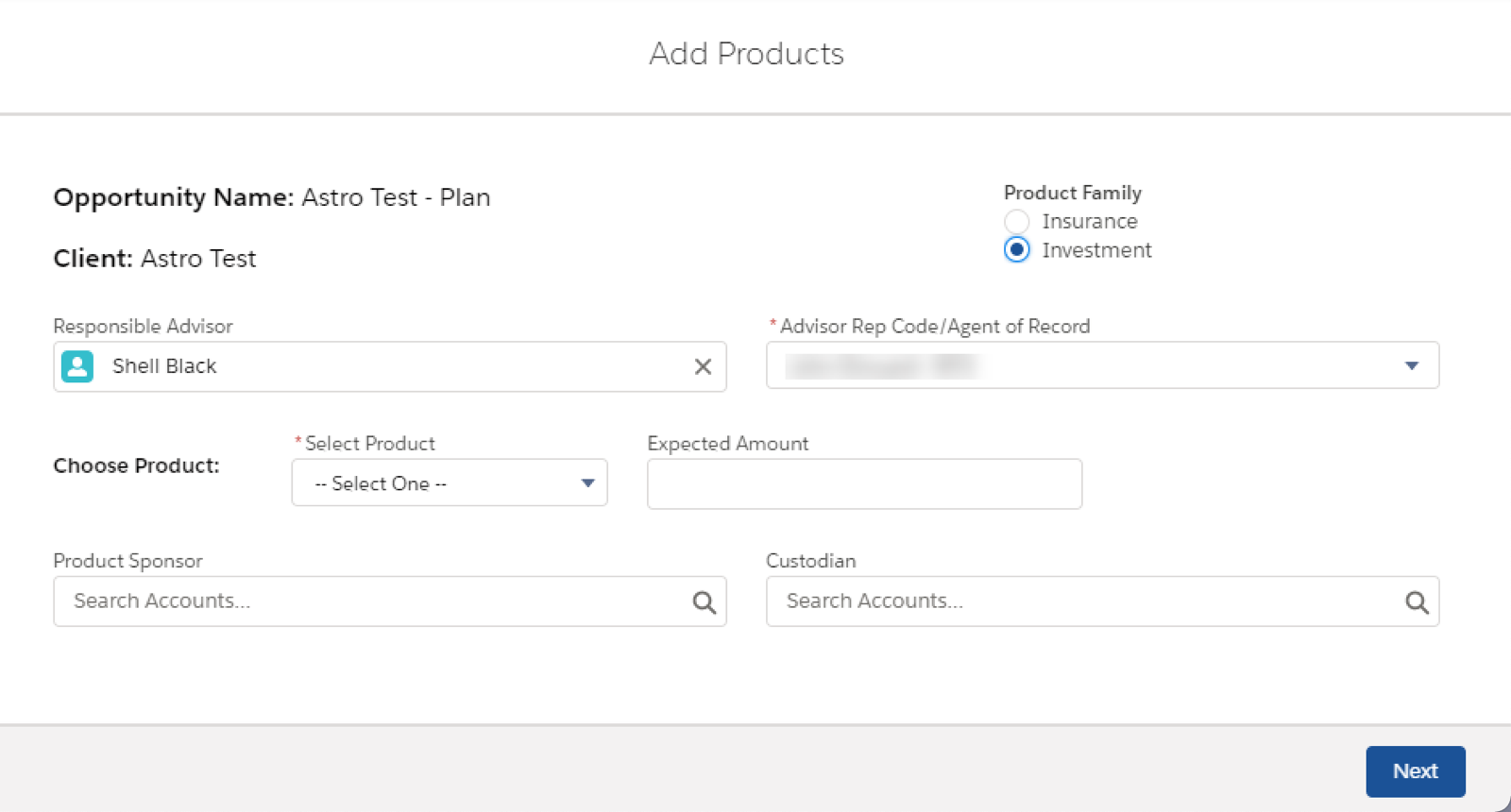

Joe really likes the financial plan delivered by ABC Financial and decides that he wants to take the advice for a new investment. The first step includes the advisor entering the recommended investment in the Add Products box.

Select the radial button to indicate whether you’re adding an insurance product or investment, then enter the requested information about each. In the example above, Investment is selected, which generates a picklist to select the product, the expected amount, who the custodian is, and whether there is a plan sponsor. If Insurance is selected, information about the carrier, death benefit amount, and the premium would be entered. More products can be added until all the recommendations are entered. After all products are entered, tasks are automatically sent to operations to find the applications and paperwork required. Each product has a different list of forms that need to be gathered and completed. Statements and supporting documentation are loaded into the system.

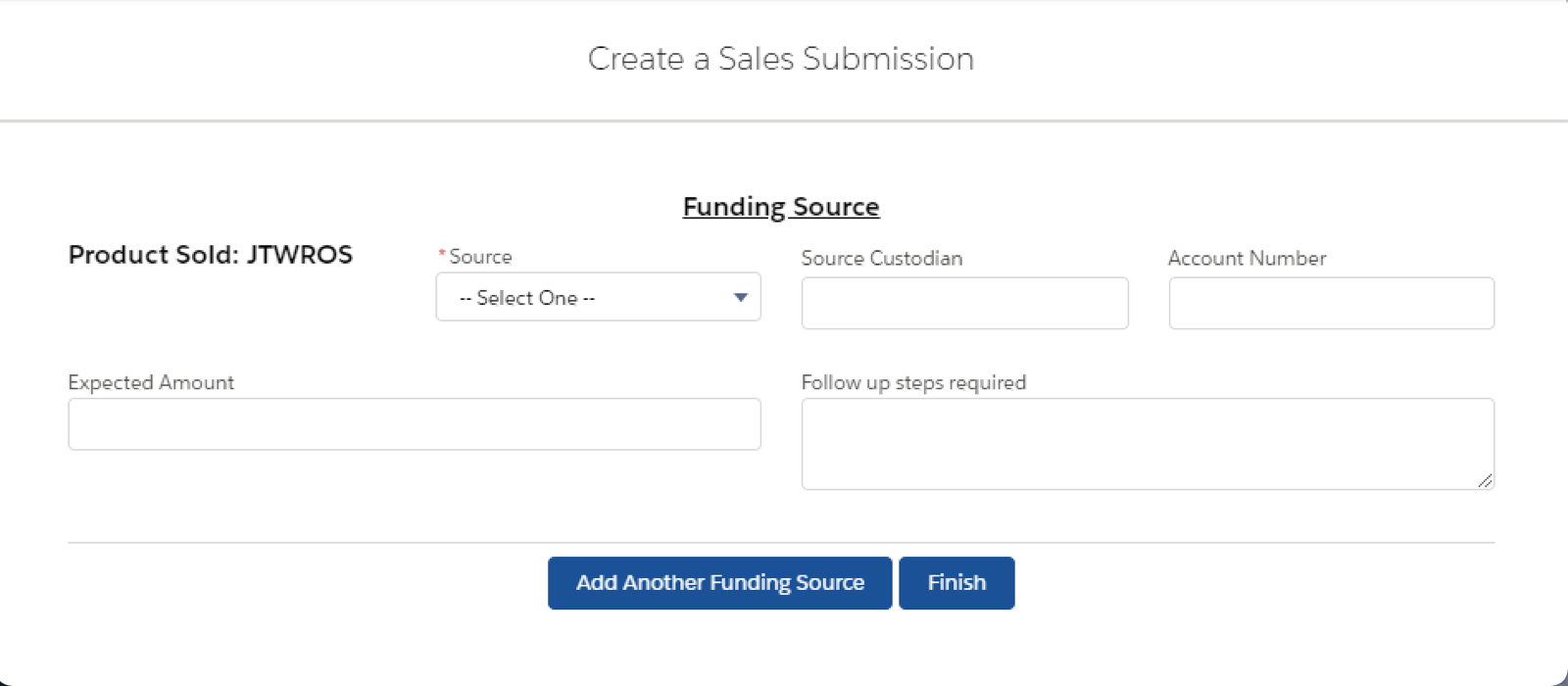

The required forms are sent to clients for electronic signatures or mailed if wet signatures are required. Alternatively, a meeting could be scheduled to review paperwork and obtain signatures. After all of the paperwork has been signed, returned, and checked for accuracy, it moves to the processing stage. In the processing stage, a button appears on the screen to Create a Sales Submission.

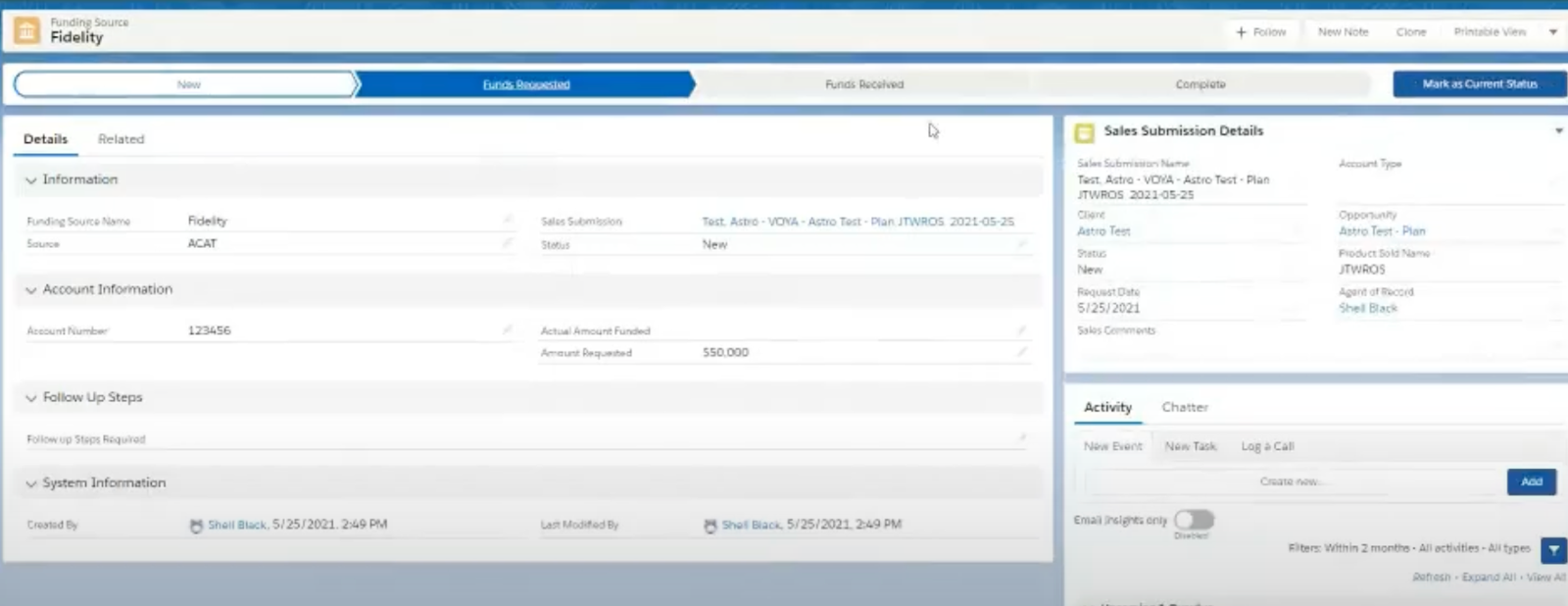

Products and investments with completed paperwork are entered to Create a Sales Submission. Funding sources are entered, and directions are logged for the operations team to watch for checks or ACATs that should be coming through. Each funding source has a record that you can reference. Each source will be followed until it is completed and funded.

Targeted steps can be added for trade reviews and compliance throughout the process. When each of the funding sources is completed, the Sales Submission record will move to Completed status. The steps along the way have tasks and checklists built-in for the operations team to set up new accounts and send out ADVs, illustrations, prospectus — only a few of the many things that are required to be compliant in the financial services industry.

When processing is complete, it moves to the Advisor Review. The advisor reviews everything that has been done. This step has a checklist for the advisor to complete. The advisor calls the client and reviews everything that has been done or sets up a meeting to deliver contracts. Next, there may be a second phase of sales that needs to be done or some additional planning.

Joe receives a call from his advisor to tell him the money has been moved and funded. The advisor then asks Joe if he has any questions, or moves forward to explore other planning areas that may be next. Joe is happy because he has been kept informed along the way and had all his questions answered — thanks to Action Plan flows that guided the team through the processes.

These examples offer a glimpse into how a consultant at ShellBlack customized Action Plans into a full sales process for our client. Every client’s processes are different, and we customize the automation to meet your specific sales or service process. Contact ShellBlack today so we can automate your process!

Author Credit:

Lisa Kilmer CFP© Salesforce Consultant at ShellBlack.com

Content Contributed by:

JoAnn Culbertson Salesforce Consultant at ShellBlack.com