From specialized tax and estate planning tools to advanced portfolio analysis solutions, it truly is a golden age of technology for financial advisors. Among the many tools a financial advisor might implement when working with clients, many advisors consider their client relationship management software (CRM) to be the central hub of their tech stacks. According to the most recent T3/Inside Information Technology Survey, 96.46% of advisors are using a CRM solution.

An advisor’s CRM is not only the source of truth for general client information such as addresses and phone numbers but it also helps the user automate business processes, track the progress of client goals, and make more informed decisions when working with clients. Let’s take a look at some of the ways CRM software can help financial planners throughout the financial planning process.

While there are many CRM solutions available, we will focus on specific solutions in Salesforce Financial Services Cloud (FSC).

Understanding the Client

When an advisor is onboarding a new client, there is a lot of information to gather. A CRM like Salesforce FSC can assist in gathering both quantitative information (names, birth dates, phone numbers, etc.) and qualitative information (risk tolerance, family history, etc.) by providing a streamlined way to gather these insights. By using prebuilt forms to collect structured data from the client, then importing the information from the completed forms to their CRM, advisors are able to deliver a seamless, modern client experience with no printing, scanning, emailing, or mailing required.

Additionally, many third-party form solutions are available for Salesforce FSC. We have implemented several form solutions at ShellBlack, including Formstack. We outline multiple use cases in a joint webinar you can watch here.

Workflows and automations specific to an advisor’s onboarding process can be built into Salesforce. This can help provide a top-notch client experience from the very start.

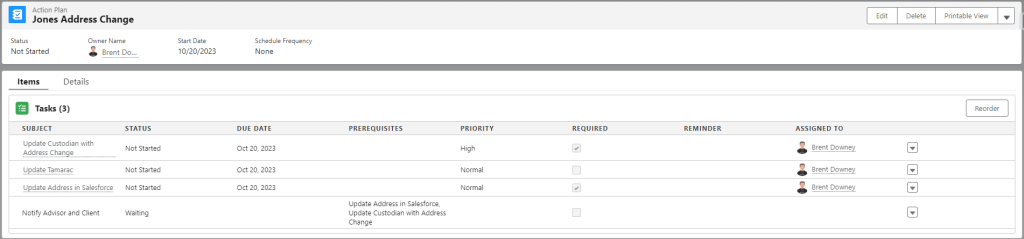

Salesforce FSC also comes with Action Plans, which can be configured to provide step-by-step outlines for your business processes.

Selecting Goals

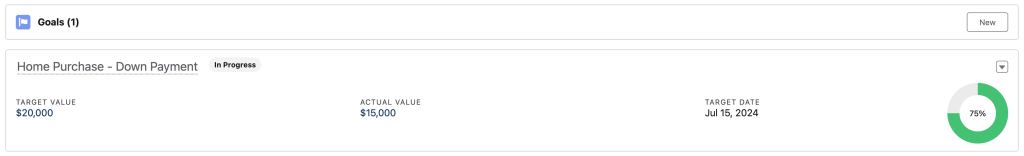

As an advisor begins to work with a new client, the financial goals of that client start to come into focus. Salesforce FSC keeps the client’s financial goals front and center by letting the user define and track the client’s financial goals right in the CRM.

Advisor Recommendations

Having all of their client information in one place empowers advisors to make recommendations using the best information available. Salesforce FSC is able to pull information from a portfolio management system, email provider, and other financial planning software to provide a holistic picture of the client’s financial situation.

For example, an advisor may see that a client is nearing retirement, but is still many years away from beginning required minimum distributions (RMDs). They may also see that the client has many different retirement account types and has expressed interest in tax planning at prior meetings. By harnessing this information through Salesforce FSC, the advisor can suggest tax planning strategies that the client can take advantage of during retirement.

Implementation and Monitoring

When it’s finally time to implement financial planning recommendations, Salesforce FSC truly shines. Here are just a few reasons why:

- Integrations with portfolio management software allow advisors to quickly see performance information and financial account details directly in Salesforce. At ShellBlack, we have successfully integrated Salesforce with many of the top portfolio management software providers, including Orion, Black Diamond, and Addepar.

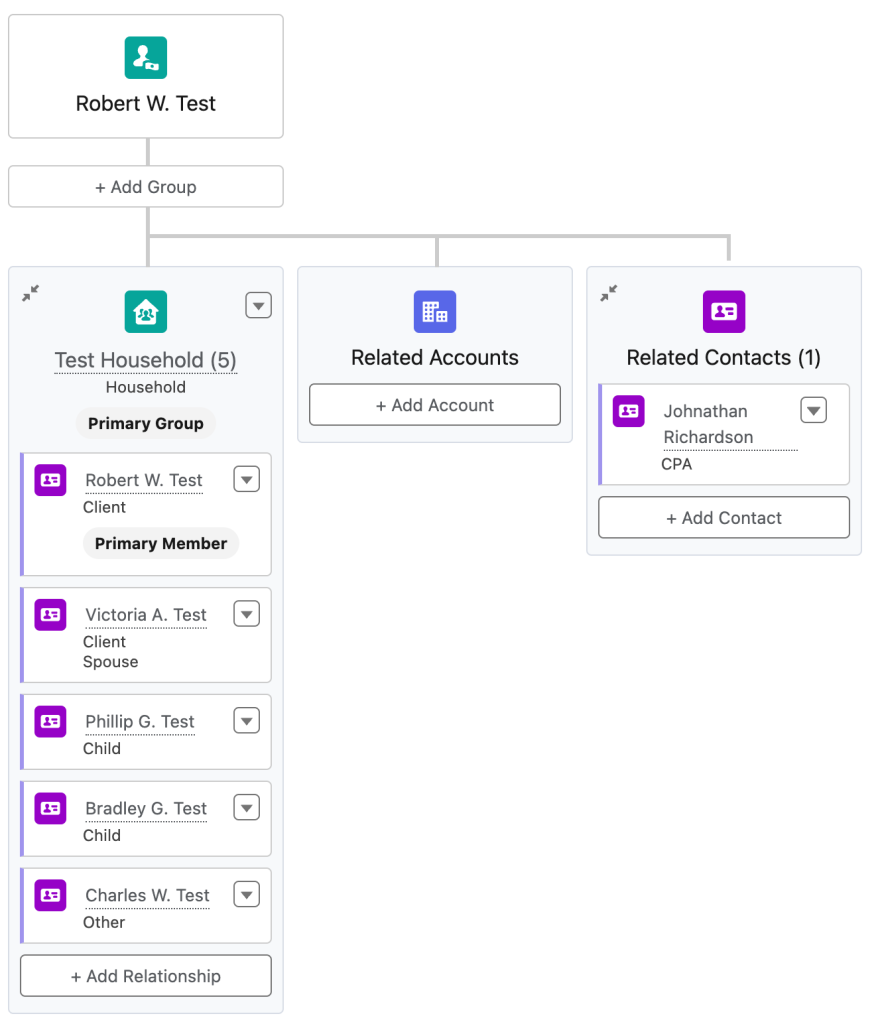

- Advisors frequently need to collaborate with their clients’ attorneys and CPAs to implement financial planning recommendations. Salesforce FSC can display a client’s outside professionals on a relationship map, making it easy for the advisor to see which professionals the client is working with.

- Well-structured client meeting notes are invaluable when implementing a client’s financial plan. We explore many of the options available for storing meeting notes in Salesforce FSC in our blog post titled: Tracking Client Meetings? Salesforce has options.

- After entering their meeting notes, an advisor can use one of many different tools available on the AppExchange to generate a PDF of those notes, along with other information about the client. This allows the advisor to quickly share meeting notes with the client, as well as get back up to speed before future meetings.

- An advisor can use Salesforce FSC to build structured workflows around specific financial planning processes, such as reviewing tax returns or estate planning. This can help each member of an advisor team stay on the same page and monitor a client’s progress by following the firm’s processes.

- Salesforce FSC can be customized to track specific financial planning information, making it easier to monitor clients individually or at a firm-wide level. Here are a couple of examples:

- The Secure Act changed many of the required minimum distribution rules for inherited IRAs. By tracking the beneficiaries of each client’s retirement accounts in Salesforce, an advisor can easily run a report to check those beneficiaries and reach out to clients who need their beneficiaries’ designations reviewed.

- Salesforce FSC can also be customized to track tax return information and specific estate planning information. These insights can be used to easily identify which clients would be affected by proposed tax law changes, or to filter the client base to see who has a revocable trust as part of their estate plan.

Whether you’re looking to unify and streamline vital client data, migrate legacy data to Salesforce FSC, or more actively monitor the client’s financial goals, ShellBlack can help you move ahead by getting back to basics with proven CRM software strategies. Learn more about our wealth management solutions.

Author Credit: Victor Powell, CFP® and Consultant at ShellBlack