Updated Dec. 12, 2023, to reflect the new name change from Pardot to Marketing Cloud Account Engagement.

If you use Salesforce for customer relationship management (CRM), why would you need to add marketing automation? Let’s take a look at a few common wealth management use cases that make Marketing Cloud Account Engagement (MCAE, formerly known as Pardot) a powerful addition for wealth management firms.

Lead Nurturing

Quality leads can be a great reason to add the newly branded MCAE solution to your Salesforce strategy. Through ongoing, targeted communication, marketing teams can identify highly qualified prospects worthy of an advisor’s time. You can use MCAE’s grading and scoring features to assign each lead a grade based on profile criteria for your ideal customer, then assess a value based on the lead’s interest in your products or services. This score is determined by the lead’s engagements — whether they have requested a demo, visited certain pages on your website and downloaded content, or clicked on a link in an email. Based on these criteria, marketing-qualified leads are sent to advisors for follow-up.

Personalized Campaigns and Messaging

MCAE can be instrumental in measuring your return on investment to determine a campaign’s effectiveness. Each interaction is tracked automatically to help the team evaluate the success of individual campaigns based on AUM growth and revenue. Without marketing automation, how are you determining the content to send to prospects? Marketing emails are often sent in a cadence, but messaging that isn’t tailored to the recipient may be meaningless to otherwise qualified individuals. MCAE makes it possible to send relevant emails at the right time, with no more one-size-fits-all marketing.

Lists — Dynamic or Static

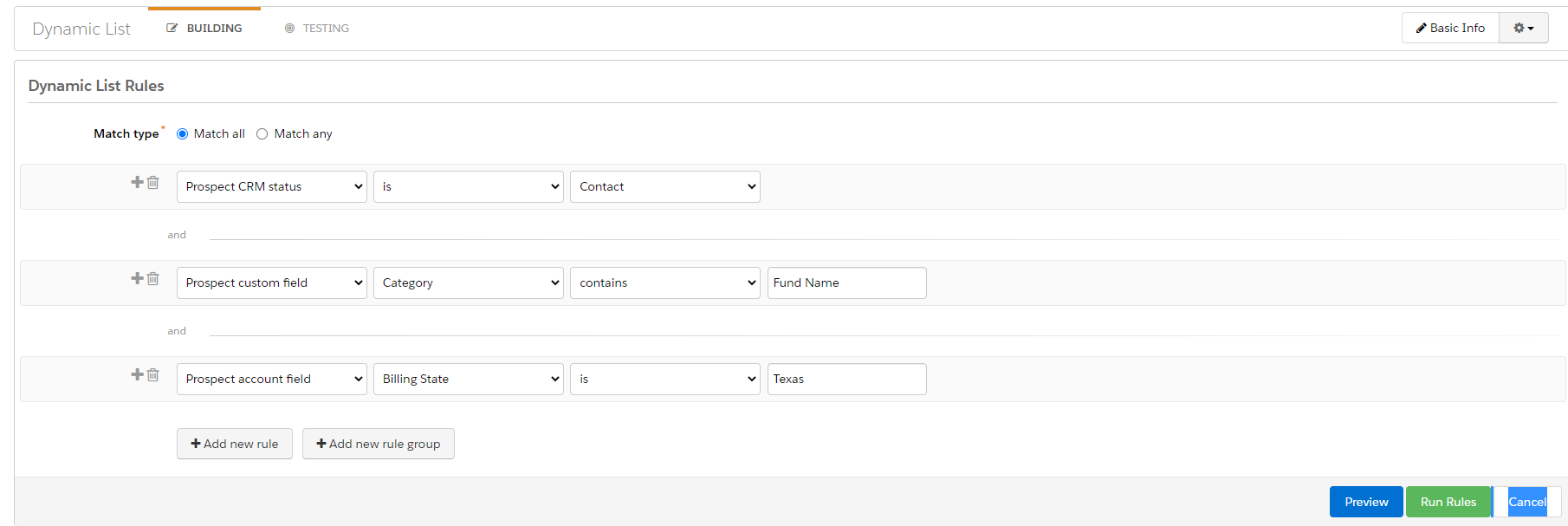

The list of clients with each holding can easily be made in Salesforce reports. Similar functionality is available in MCAE using dynamic lists — an extremely useful automation tool that generates an up-to-date list based on matching rule-based criteria. For example, is the client invested in a specific fund? After defining the rule criteria once, the dynamic list will continuously use that rule to add and remove investors from the list, which saves valuable time. When using dynamic lists, you cannot manually add or remove people. The list refreshes at regular intervals, looking for clients who match the set criteria and removing those who don’t. The list can then be used to send emails to the intended recipients, or as a suppression list when targeting new fund investors.

Sales can also use tailored automations to market new funds or additional funds to existing investors. Sales representatives for investment management are often talking to advisors or analysts at consulting companies who recommend their clients invest in the funds. If the advisors and analysts are interested in certain strategies, they can be added to static lists that are used to send relevant fund information.

Send Compliance Material

Another use case for MCAE is sending out emails with annual required compliance material for investment management firms. Investors can be people, pension plans, institutions, or trusts, just to name a few. Investors, or their representatives, need to be sent compliance material at least annually. This material can include the ADV or a privacy statement. A link to the compliance documents is embedded in the email so the client can click on it to download the content. Although Salesforce does allow sending of mass emails, it is usually recommended to use some type of add-on, such as MCAE or another third-party email tool because of deliverability issues and other functionality.

To ensure these critical emails reach the recipients, MCAE has a feature called Operational Emails that can be enabled. This feature is available in all Pardot/MCAE editions. By enabling the feature, these non-marketing emails can be sent to designated recipients on MCAE List emails, even if they have opted out of marketing communications.

Books and Records rules require organizations to supply the history of when the compliance material emails were sent if regulators request it. MCAE retains that information so that the history can be easily provided. For those firms that must also archive their emails via a third-party system, MCAE has a feature called BCC Email Compliance, which is available for an extra cost. By activating this feature, any email you send through MCAE is blind-copied to your BCC address.

Anniversaries and Birthdays

Advisors often send personalized wishes to clients to celebrate special days. You can utilize MCAE to track anniversaries and birthdays and to create automations to send emails to clients on their special days.

Newsletters

Many firms send out newsletters or quarterly touch points. MCAE makes it easy to create a reusable template that is branded with your company’s information to give it a consistent, easily identifiable look and feel. This template can be used repeatedly as the basis of your newsletter and sent to individuals who’ve opted in for these communications.

Internal Communications

Many firms leverage marketing automation to send out internal emails to their staff, using dynamic lists to ensure that the employee list is always up to date. Since MCAE tracks opens and clicks, senders can ensure their emails have been received and reviewed by their internal team.

Onboarding New Clients

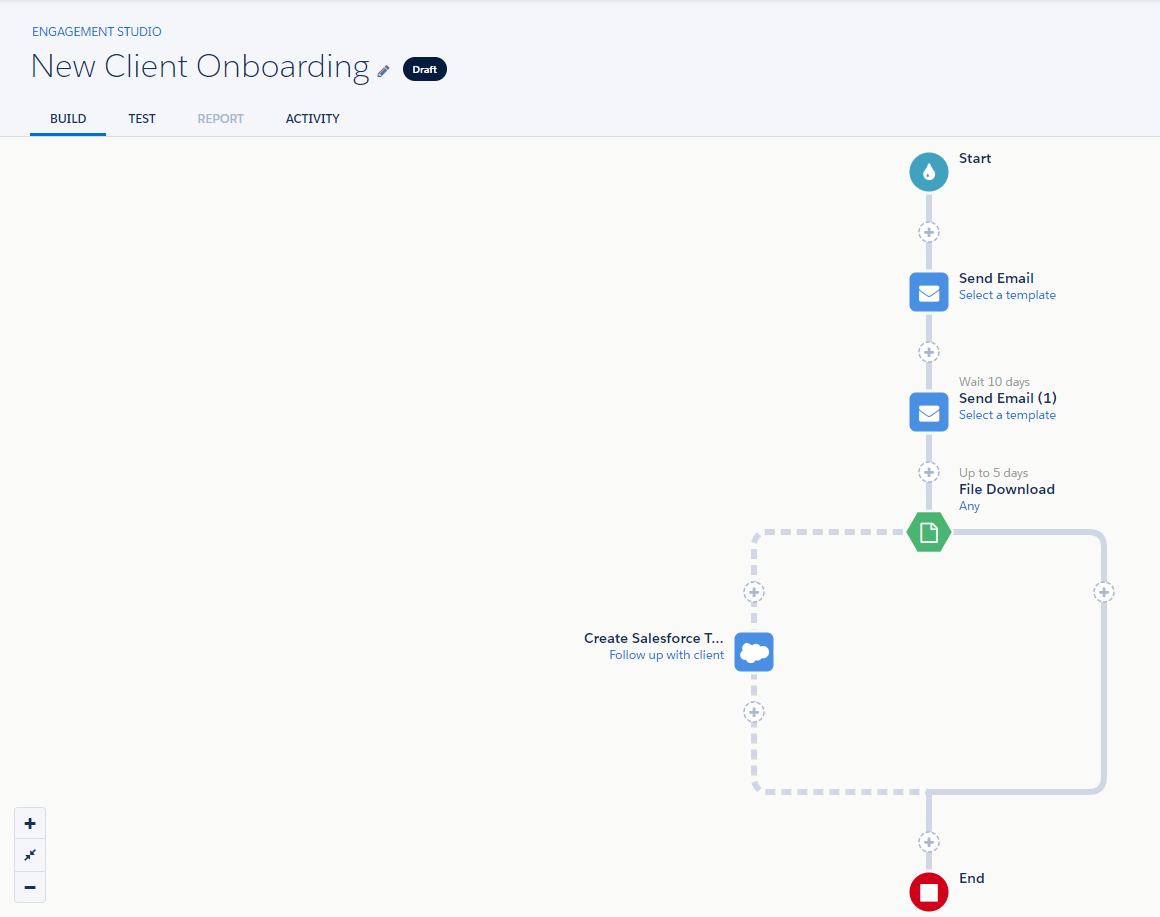

When advisors onboard new clients, a lot of information typically needs to be communicated in the early stages. Often, advisors will utilize MCAE and the Engagement Studio feature to send out specific touch points during the onboarding process. These can be set to send on a specific cadence, or when certain criteria is met.

These are just a few of the ways MCAE is building on the strength of Pardot to help wealth management firms streamline their communications. Contact ShellBlack to discuss your use cases and how MCAE can help.

Author credit:

Lisa Kilmer CFP©, Salesforce Consultant ShellBlack.com

Marnee Lott, Director of Marketing ShellBlack.com