A quick disclaimer: I won’t spend any time on the AI announcements at Dreamforce 2023, as that was covered in another post Dreamforce 2023 — A Keynote Recap Starring AI. For those interested in learning more about how AI might open up new opportunities for Financial Services, though, here is some suggested reading:

- The Rise of Finmachines: Six Potential Banking Applications for Generative AI – Forbes

- Can Generative AI Truly Replace a Financial Advisor? – FT Adviser

- Why Generative AI Is Banking’s Solution to Big Tech Challenge – The Fintech Times

DREAMFORCE SESSIONS

Sessions at Dreamforce are always hit or miss. I attended more than one Financial Services (FINS) session with a riveting title, only to be presented with a commercial for Financial Services Cloud (FSC). I could see others felt the same when I looked around the room and saw faces buried in their phones rather than listening to the presenters. However, I do believe the two sessions highlighted below hold relevance for our Wealth clients.

The Complete Wealth Experience

with Michelle Feinstein (GM/VP Global Financial Services Solutions & Strategy at Salesforce)

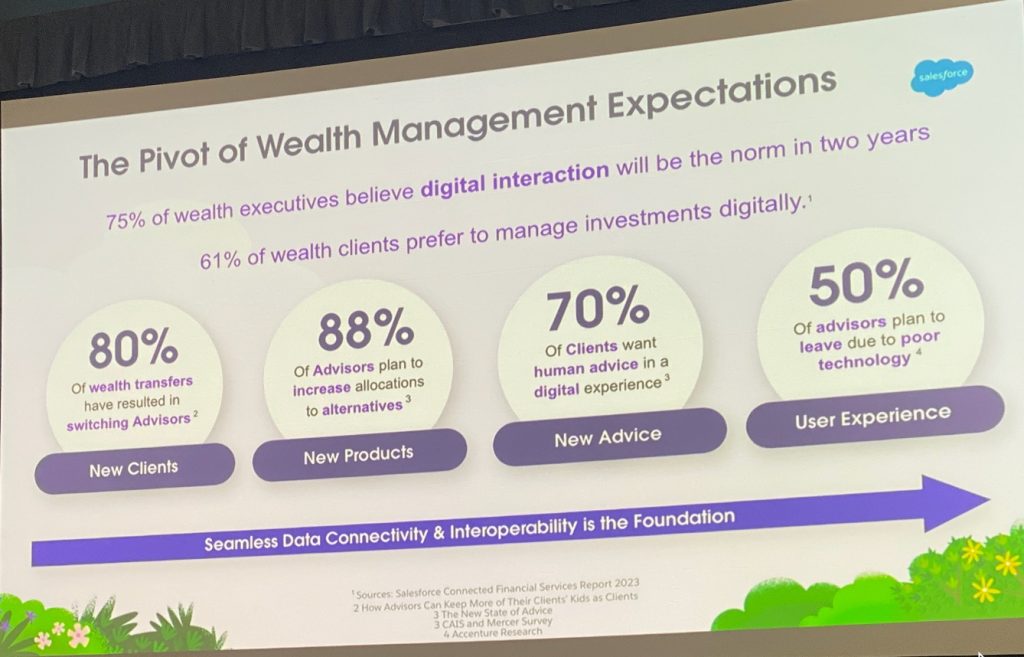

The pivot of Wealth Management expectations

This session started by pointing out some of the problems facing Wealth Management today. There is a huge opportunity to service not only ultra-high net worth clients, but also the “mass affluent” — those with $250K–$1MM to invest. How do we scale Financial Advisors to chase this opportunity, especially when 70% of client systems are not integrated and 80% of customers want advisors closer to their age? How does the industry increase interoperability and bring in younger advisors?

Top priorities for wealth firms

What are firms doing to meet these challenges? There is an opportunity for straight-through processes — unifying the experience across advisors and support staff. How do you boost advisor productivity? You start by connecting all the data (which can take 12 to 18 months, so start now). Having your data in Salesforce opens the door to automating your processes. At that point, you can more effectively manage the customer journey and specific interactions. You’ll also need to take a holistic approach, as the journeys are complex. Whew — that’s a tall order!

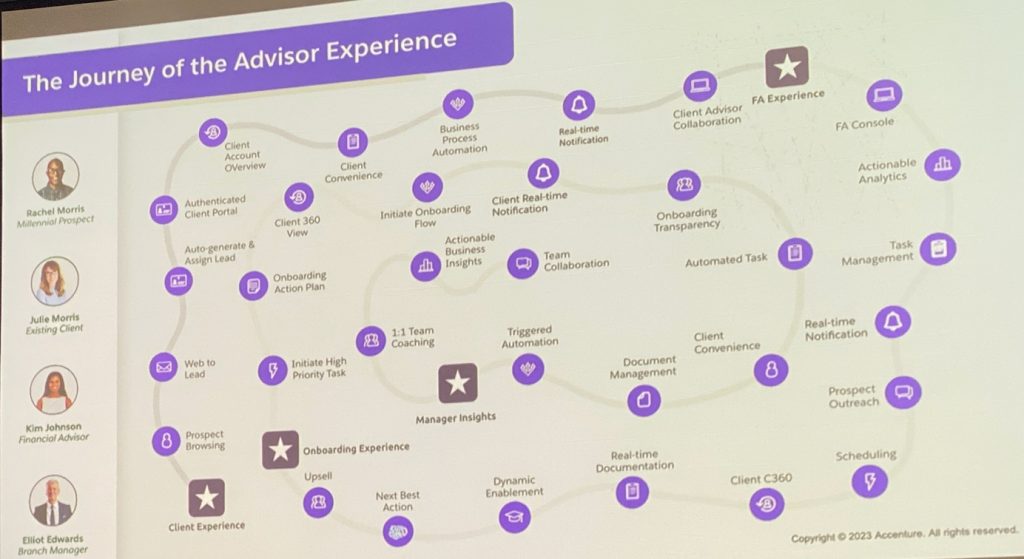

Journey of the advisor experience

What makes managing the customer experience even more challenging is that there are five generations of investors with different expectations of how they want to interact with an advisor and a wealth firm — including marketing and compliance communications.

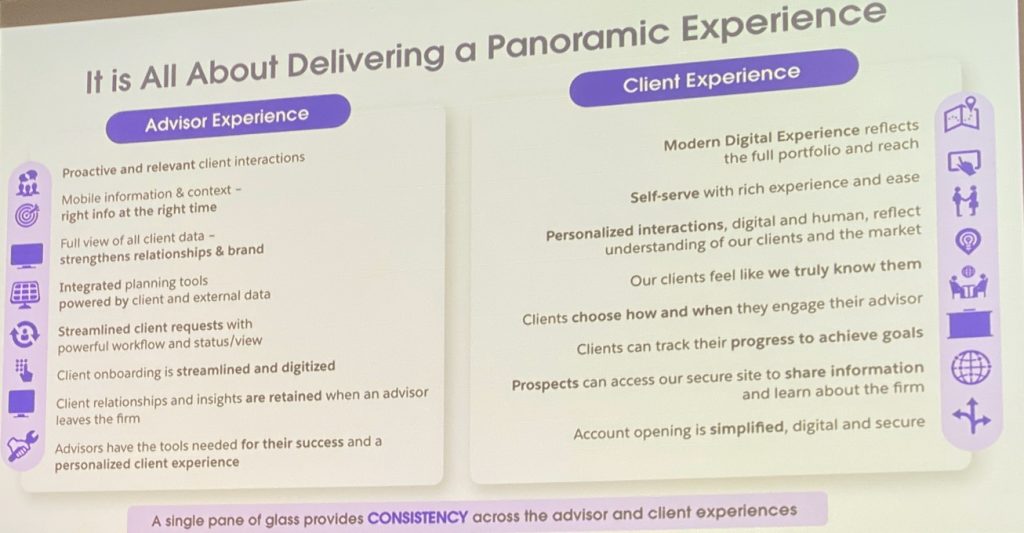

Panoramic experience

The advice was to focus on the client experience, not just the Financial Advisor. The client experience is the differentiator in Wealth Management.

Unifying the advisor experience through interoperability was another key takeaway of this presentation. On average, wealth firms work with 37 systems. The presenters recommended obtaining a complete list of those systems, then scaling back based on where Financial Advisors spend their time. The goal should be to get this number down to four or five essential systems, such as email, CRM, a Portfolio Management System, etc. If you are chasing interoperability, where do you put everything? Your options are a custom platform, a custodial system, or Salesforce.

A repeating theme at these FINS sessions is that you can’t tackle transformation until you resolve issues with the data layer and data management. To do this, you’ll need a cross-functional team —advisors as well as team members responsible for the client experience.

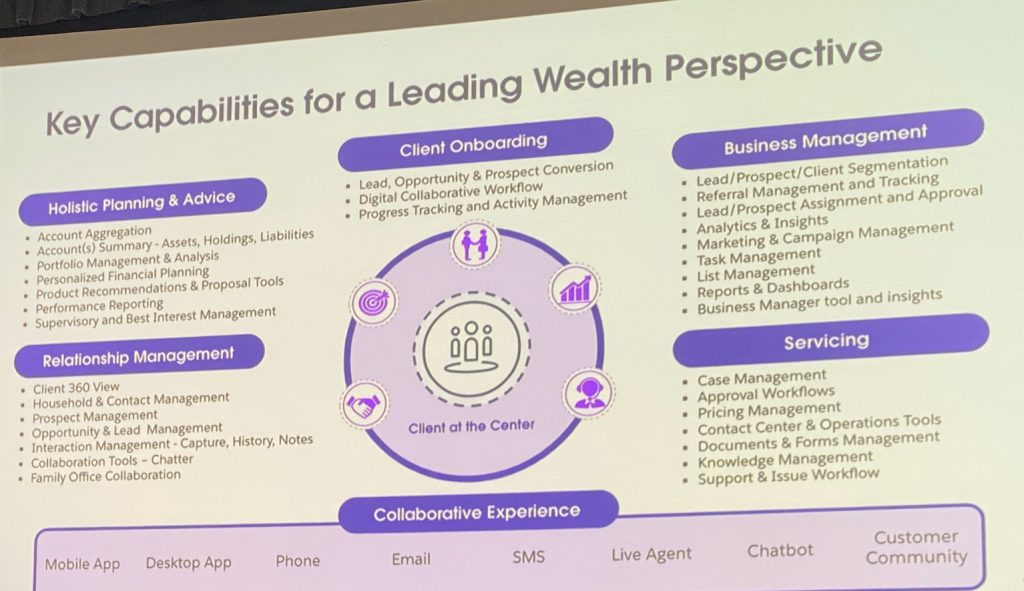

Key capabilities

The slide above, per the presenters, is the blueprint, and client onboarding is the big pain point. Onboarding starts with the prospect’s first contact with your brand and how you respond. You start gathering information as the process continues, always keeping the client at the heart of the experience. People tend to struggle with how much planning information should be in the CRM. The goal is not to make CRM the financial planning tool. Instead, you should just hop out to the planning tool from Salesforce.

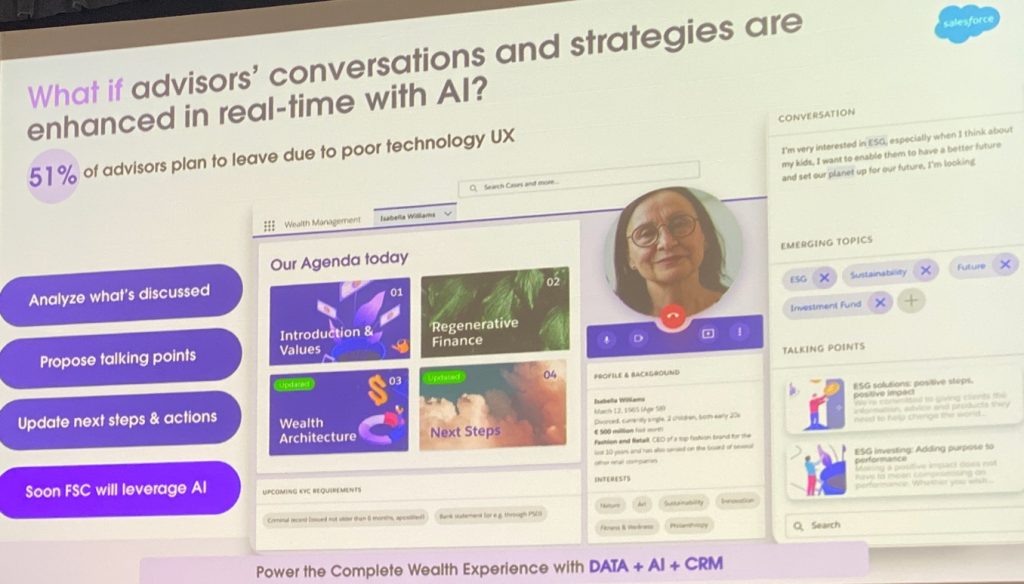

Wealth and AI

How can Financial Advisors leverage AI? This technology can capture and summarize conversations, take notes, and recommend next steps. For example, AI can summarize the history of a 20-year client relationship for advisors who are new to the firm or new to the client. Advisors should be aware of concerns such as AI bias, but these concerns do not outweigh the risk of falling behind by failing to explore the technology.

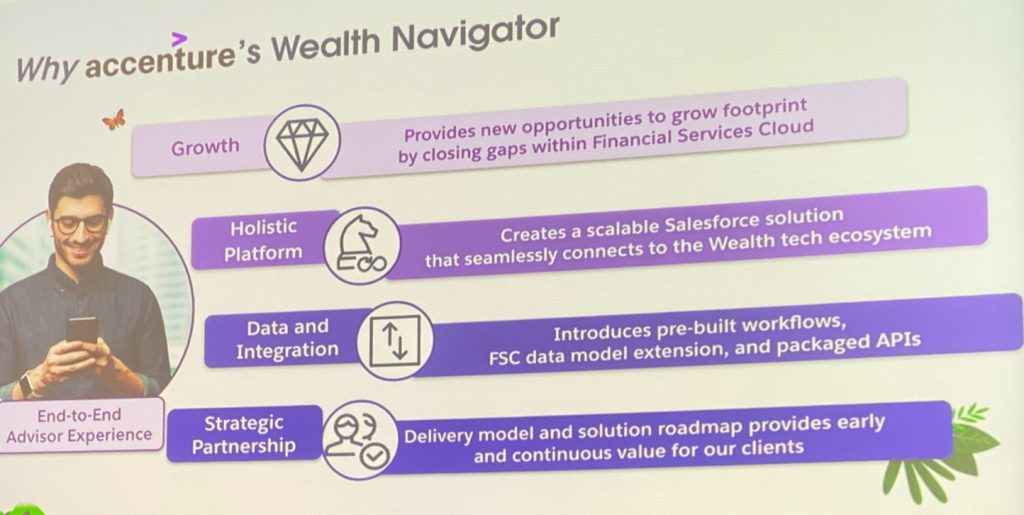

The session concluded with a plug for Accenture’s Wealth Navigator.

Wealth Navigator

Is this an über-app? No. It extends the FSC data model by integrating and orchestrating workflows. The thought is that not all wealth firms want to create their own solutions. Accenture and Salesforce are creating standard operations that you can tailor based on your usage.

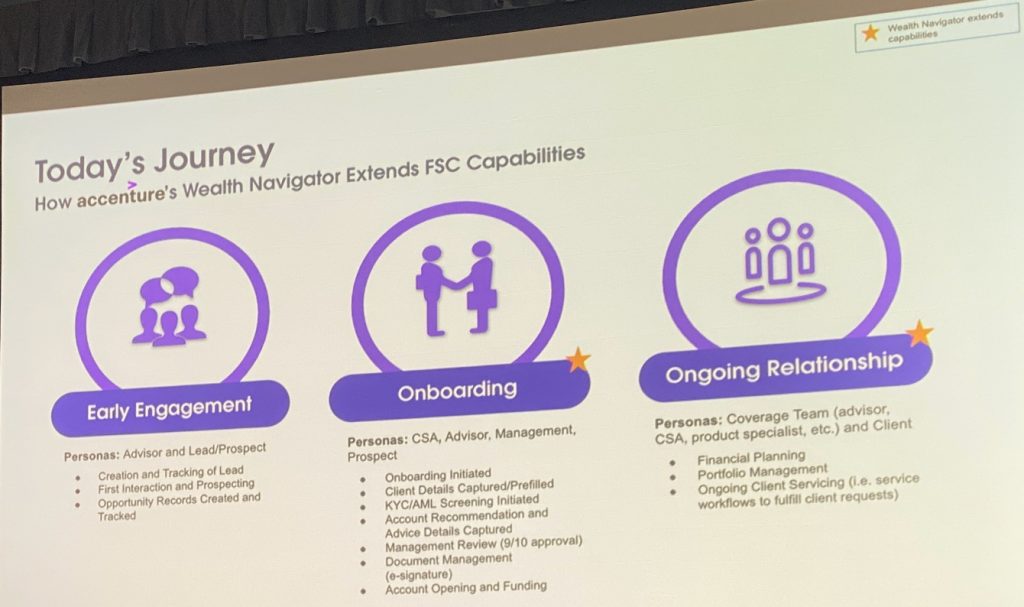

Today’s journey

What’s in the minimum viable product? Onboarding will be available in 12 to 18 months. They are working on the partnerships (eight to 10) needed for digital onboarding. Accenture will create these integrations.

The basic flow of the demo was as follows:

- You are working with a prospect

- You capture notes and attachments

- You click the “Initiate Onboarding” button

- You pick an Account Type (Retirement, Trust, Individual, Joint, Traditional IRA, Roth IRA, etc.) Contact Details are pulled in from the CRM to save data entry

- You continue to fill out form details through screens that you normally would see in external systems (this data does not need to reside in Financial Services Cloud)

- The orchestration is happening through APIs (for example, they are not building a Know Your Client engine, but rather calling one with an API)

- Funding methods are done through integrations

- Finally there is a Management Review step and eSignature, and the financial account is opened

This application from Accenture does not eliminate the need for a Portfolio Management System, but it does aim to reduce the number of applications needed. The goal is interoperability of the data. What’s the data layer? It’s Mulesoft. There are two ways to get access to Wealth Navigator — through Accenture or as an unmanaged package via the AppExchange. Accenture is working with the FSC product team so that, feature-wise, they do not step on each other’s toes.

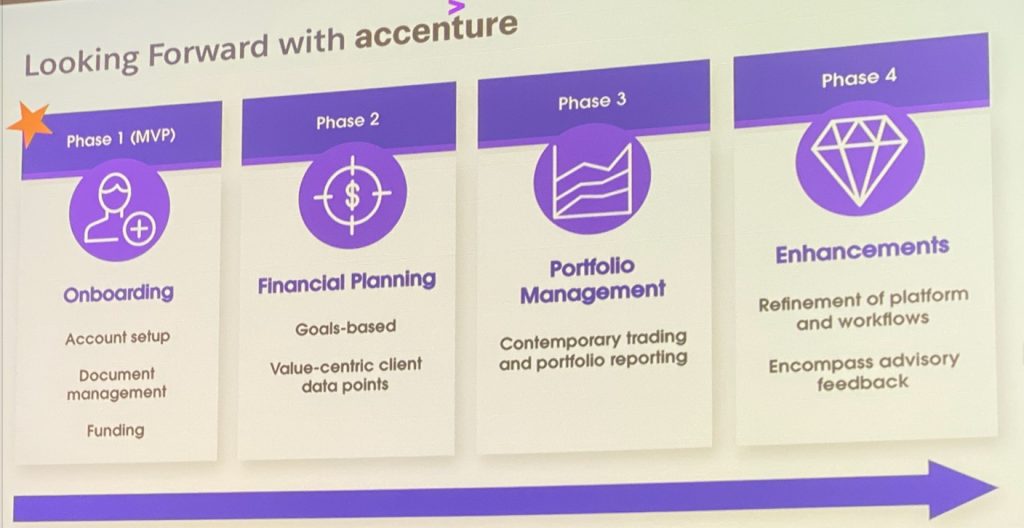

Navigator roadmap

Creating the Next-Generation Wealth Platform — PershingX and Wove

The setup for this session is that Financial Advisors deal with a “Frankentech” tech stack today, and the goal is to give advisors 20–30% more time to serve their clients.

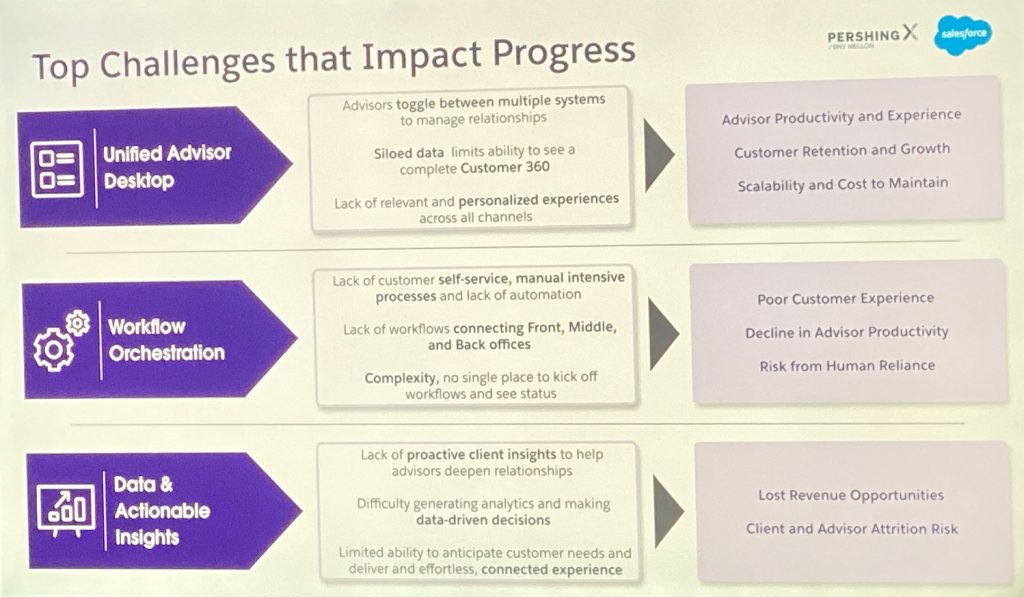

Top challenges

What does Wove from PershingX solve? It started with an advisor survey, as well as user journey and flow research, to determine where productivity goes to die. Portfolio construction and onboarding are two of the top three graveyards.

Who are the partners that comprise Wove? Snowflake is the data cloud, Salesforce and FSC are the CRM, planning is via Conquest, the billing partner wasn’t mentioned, and the trading platform was built from scratch by PershingX.

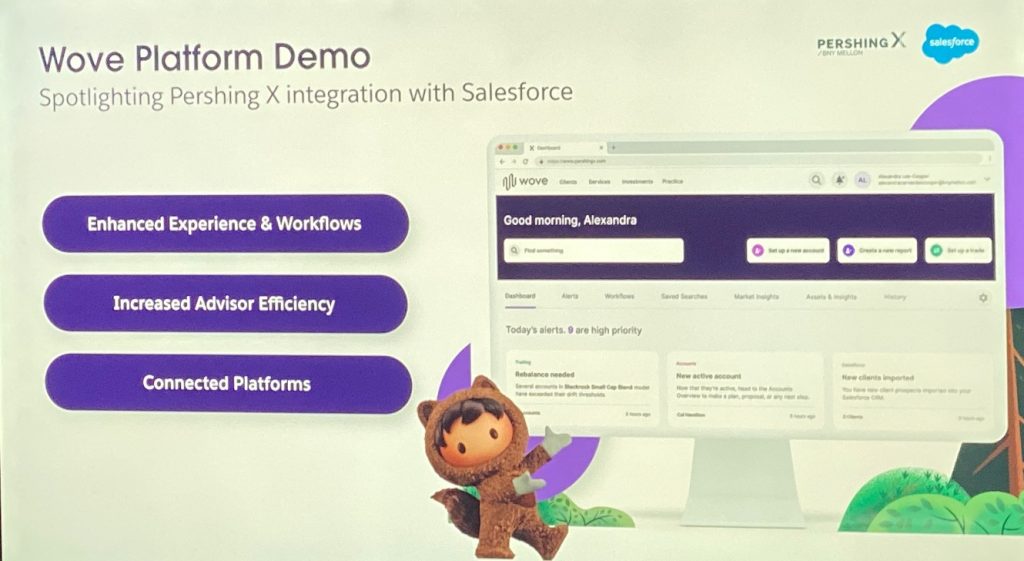

Wove demo

Wove is an interoperable tech stack being released in phases. First is the connector app with bidirectional data syncing. The connector app helps firms channel data points into Salesforce. Prospects and Households that become Opportunities in Salesforce are sent over to Wove to open an account with multiple custodians from within the Wove experience. Once the account is open, data such as an account number flows back into Salesforce.

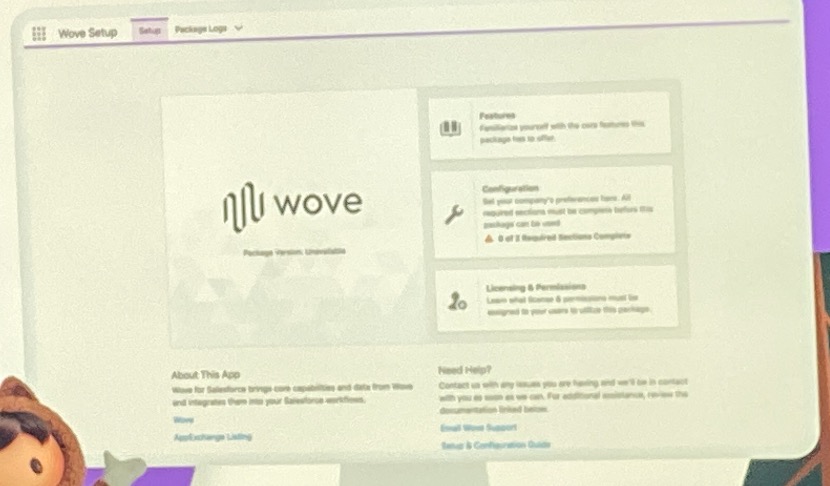

In Salesforce, as a System Administrator, you make the connection to Wove.

Connect to Wove

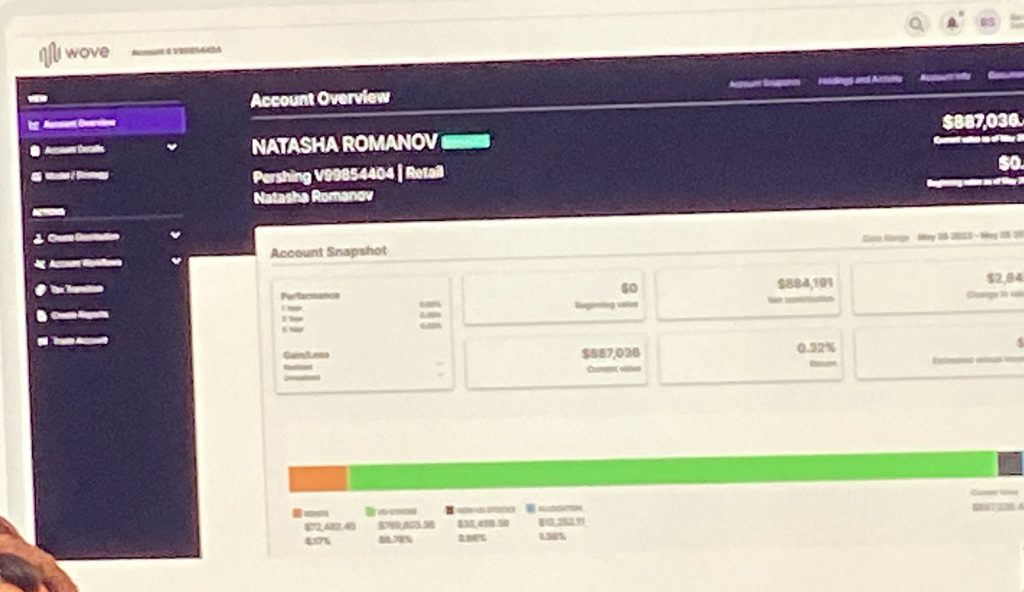

Once connected to Wove, you can see the Financial Account. In later releases, you will be able to edit this information.

Wove account

The screenshot below is Salesforce in Wove. The idea here is to deliver the same experience whether in Salesforce or Wove (interoperability!)

Salesforce within Wove

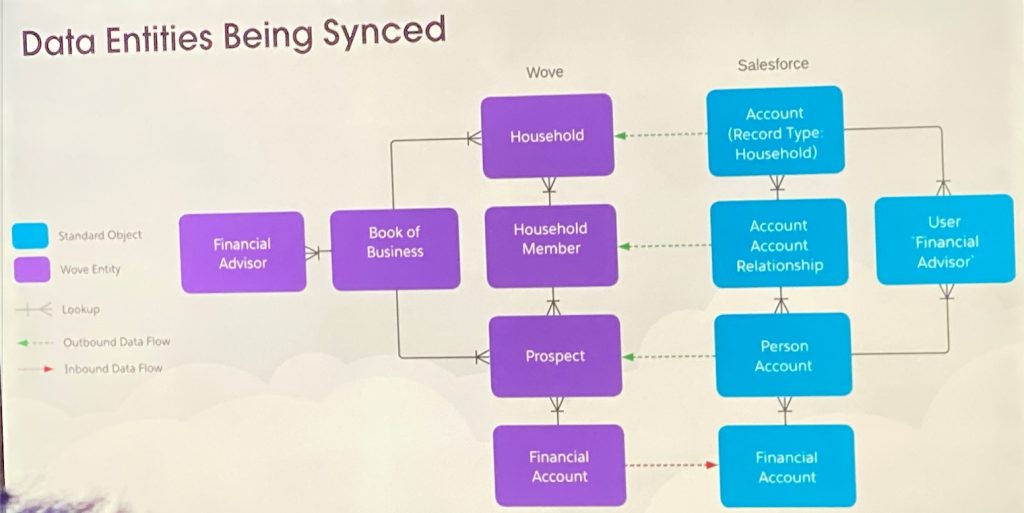

So, what’s the Wove data model? The data objects that are in sync between Salesforce and Wove are the Household (Account) and Prospect (Person Account). Once the Financial Account is established, the account number is sent back to Salesforce.

Wove Data Model

What’s the roadmap for Wove? After the connector app, PershingX will continue building out the solution. The PershingX team claims to have the needed investment and a long runway. Next is a multi-custodial investor portal to eliminate the need for advisors to log in to multiple portals.

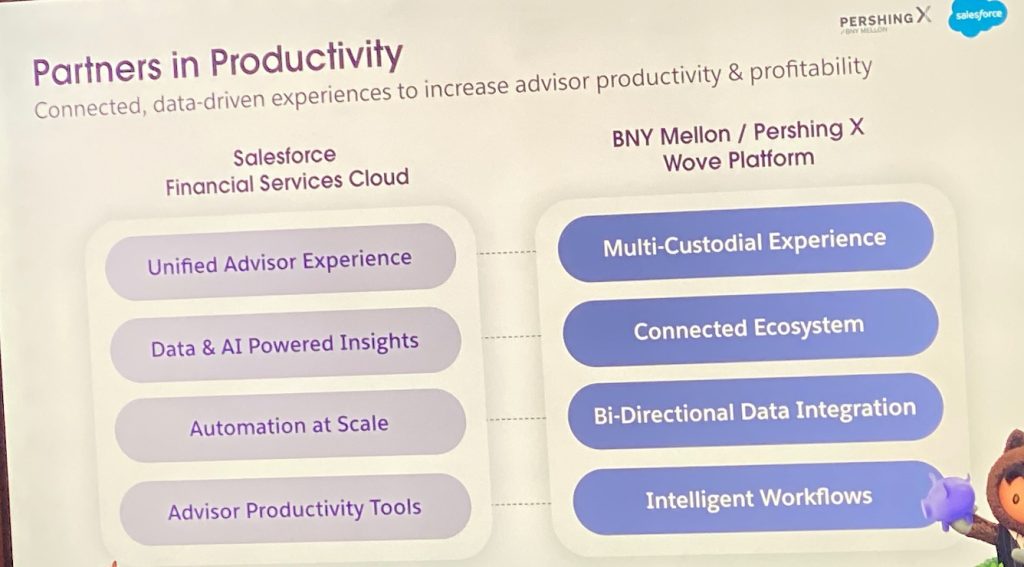

Partners in productivity

CONCLUSION

The reality is that all but the largest 1–2% of wealth firms (think Barron’s Top 100 RIAs) could even consider covering the costs of developing their own bespoke solution for digital onboarding. For all others, that means you’ll have to use an app — perhaps Accenture’s Wealth Navigator or PershingX’s Wove. There is another player, Skience, but they have stumbled lately, so there may be an appetite for new options.

At first blush, it seems that Accenture and PershingX are taking different approaches to solving the digital onboarding problem. Accenture’s Wealth Navigator workflow appears to keep the user in Salesforce and bring data in from custodians using APIs. In contrast, PershingX’s Wove uses Salesforce (at least initially) just to launch out to the Wove platform, where a new account is opened and the account number is sent back to Salesforce.

What I could not discern at these Dreamforce sessions was how much functionality is up and running and ready for Salesforce customers and how much of the content was a roadmap discussion. That being said, digital onboarding is a silver bullet that is frequently requested by our clients — so watch this space!