Wealth advisors work with many types of clients. Some people and families have straightforward wealth management needs, while others may benefit from more comprehensive financial planning to evaluate and explore relevant insurance solutions. Other types of clients include corporations looking for a knowledgeable advisor to help manage their 401(k) or group benefits such as group life, group disability, and group health insurance. Advisors often have a combination of these clients. Financial Services Cloud supports varying degrees of customization for all these client types to convert leads into the appropriate accounts.

Lead conversion is an area that often needs some customization to make it as seamless for ShellBlack clients as possible. Different types of leads need to be converted into different types of accounts. Most commonly, people need to be converted into Person Accounts and Households, and business clients need to be converted into Institutions. This topic is so popular among our clients, we previously wrote a blog discussing two tools we usually recommend — the free app on the AppExchange from Salesforce Labs and our very own ShellBlack Accelerator. In this post, we’ll discuss another way we use the free app for our clients.

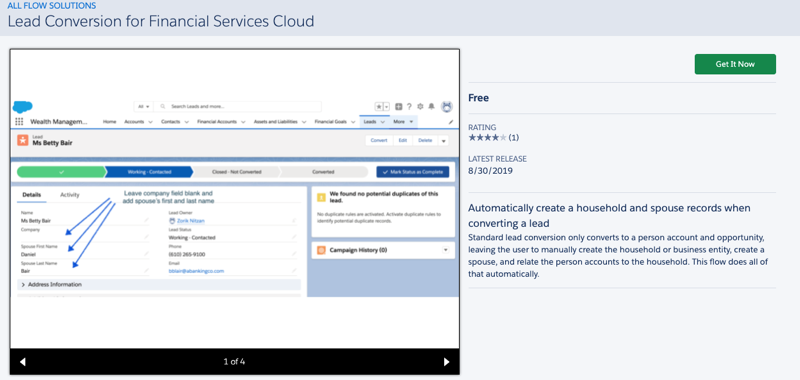

The app, Lead Conversion for Financial Services Cloud, has a flow that facilitates the conversion of a lead and their spouse into two Person Account records, as well as a Household record.

The app also creates an opportunity for the Primary Member of the Household. It adds Spouse First Name and Spouse Last Name to the lead page layout and creates the Account-Contact Relationship (ACR) that will show up in the Relationships tab on the Household or Person Account. The first change we make to this flow is to change the role given to the clients.

Out of the box, Financial Services Cloud assigns Other to both, and these can be changed in the flow. One option is Client and Spouse, and another is Primary Member and Secondary Member. If the Company field is filled in with the Corporate Client Name and the First Name and Last Name fields are completed for the contact at the company, this will also convert to an Institutional record type and the related Contact record type. This conversion also creates an opportunity.

This is all that is needed for some clients. But if the wealth management firm works with corporate clients and manages 401(k) plans, for example, a little more customization may be in order. The flow begins with a Process Builder that is triggered when the lead is converted. It passes the record ID into the flow. In our case, the consultant changed the flow after this step to determine whether the lead is a Person or a Plan Entity. If it is a Person, the flow follows the usual conversion that creates two Person Accounts and connects the ACR to a Household. If it is a Plan Entity, it creates two Contact records for the company’s contacts — perhaps the HR contact and the plan administrator. This saves time by eliminating the need to go back in later to add the other contact and relate the records. The flow makes the ACR connection so that they are both related similarly to the two Person Accounts and the Household previously discussed. Another branch of the flow could be added to create more account types if needed.

The opportunity is changed in the flow to be associated with the Household or the Plan Entity instead of a Person Account. Most of our clients prefer to manage their opportunities and cases from the Household level, so they want to see this information on that record.

If a person is a member of more than one group — for example, their Household and a Plan Entity — the information can be brought from the Plan Entity to the Person Account of a Plan Entity participant. The consultant has another Process Builder that adds Lookup fields on the Person Account when the ACR is created so that Formula fields can be populated with information about the plan relevant to that person, along with a link to the plan. Other fields that would be convenient to see on that record can also be brought to the Person Account with automation. These different group relationships can be seen in the Relationship Groups component, which can be added to the Person Account Lightning page.

If you’re ready to save time by customizing your lead conversions in Financial Services Cloud, talk to ShellBlack about effective automations tailored to support your business model.

Author Credit:

Lisa Kilmer CFP© Salesforce Consultant at ShellBlack.com

Content contributed by:

Brian Knezek Salesforce Consultant at ShellBlack.com