Like most businesses, wealth management firms need to keep track of clients’ addresses. Some clients have jobs that require them to move frequently — whether it’s an athlete moving to a new training location or a consulting professional whose job location changes as work is completed and a new job starts. Some high net worth clients have multiple homes that they move between, and everyone buys and sells homes periodically.

Compliance is one reason financial advisors need to keep track of clients’ addresses. New business applications must have a current address listed, and a different mailing address can usually be listed as well. Some applications need to list the city and state where the application was signed. There are also rules about where the advisor needs to be licensed, where the client is when signing the application as well as where they live. The Patriot Act added many requirements, and verifying addresses is only one of many. For advisors who work with clients in multiple states, it can be a lot to manage.

Consultants at ShellBlack have frequently had this requirement from our clients, and this is one of the ways that we have automated this process.

The requirement was to be able to add a new address, invalidate an old address, or change the mailing address of a client. ShellBlack clients wanted the address on the Household record detail to be updated to the current mailing address because they have another automation that uses the address from the Household record to mail compliant material to their client. We have other clients who only manage the address in this component. We use the Address object so that multiple addresses can be listed.

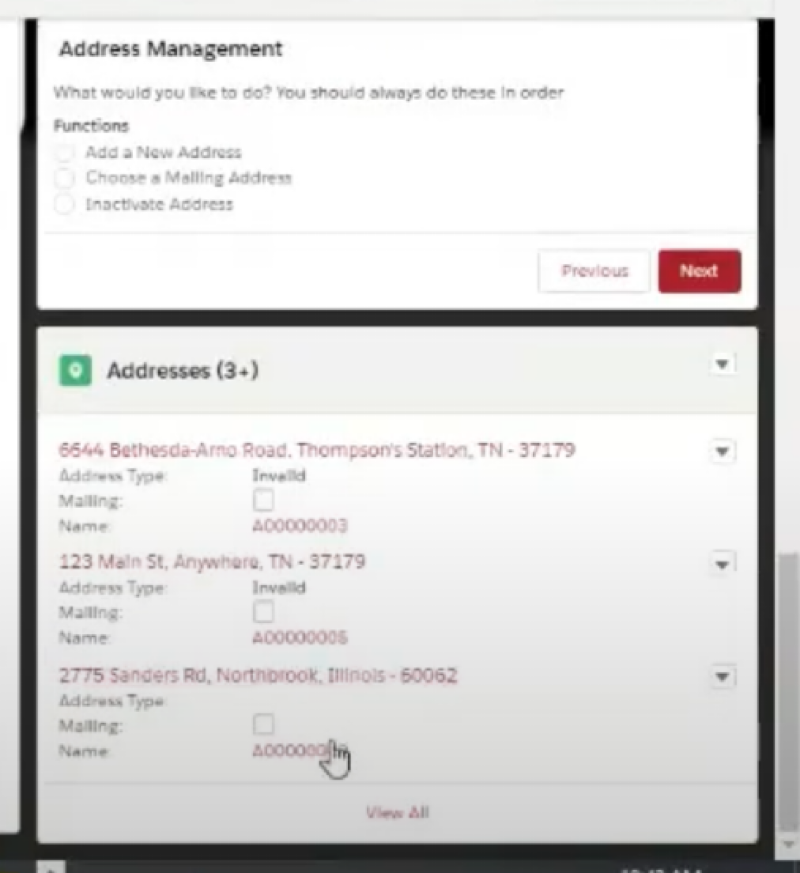

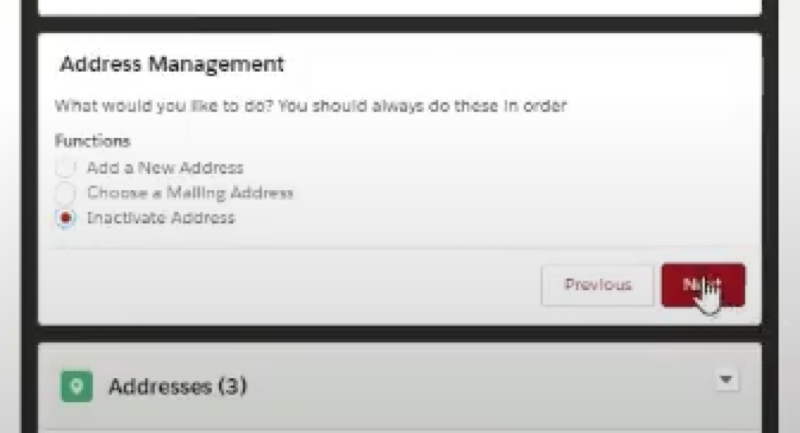

The process starts on the Household record in the Address Management component. Select Next, and there are three choices:

Add a New Address,

Choose a Mailing Address

Inactivate Address

Select Choose a Mailing Address and click Next

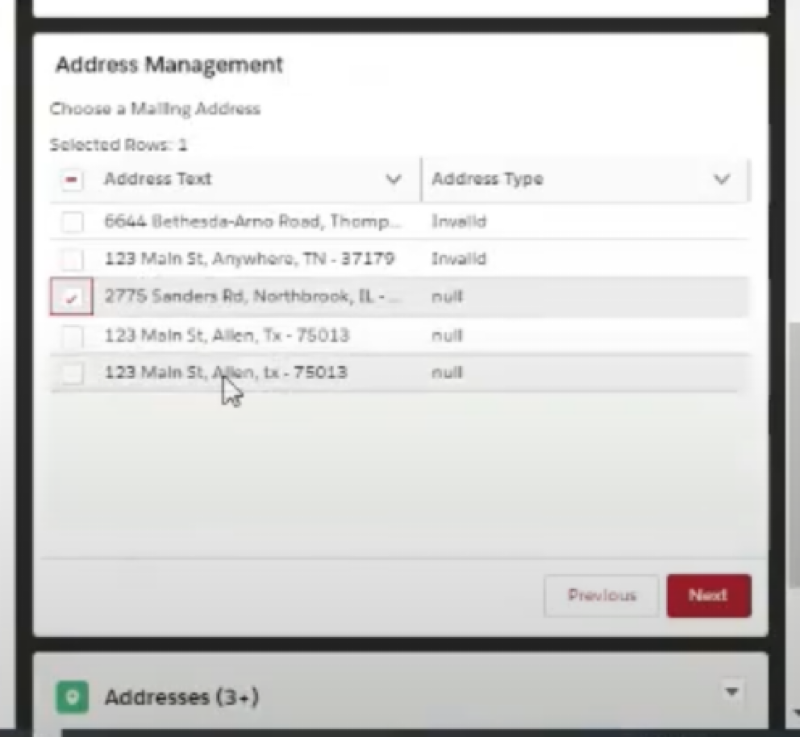

From the list of addresses that appear, select the checkbox next to the address you’d like to set as the mailing address.

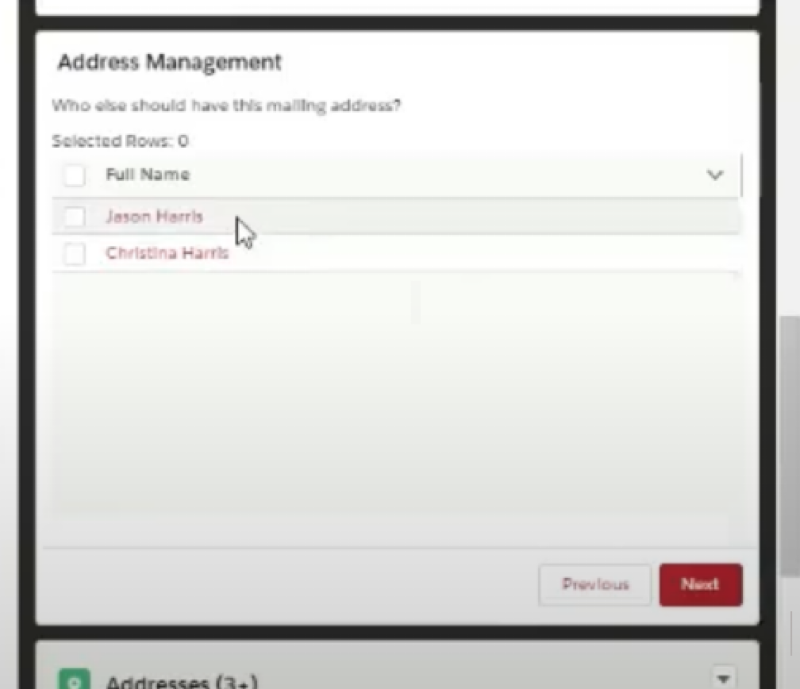

The next screen asks which member(s) of the household should have their address updated. Select the checkbox next to the appropriate member(s).

Select Finish on the next screen to update the record for each person you selected.

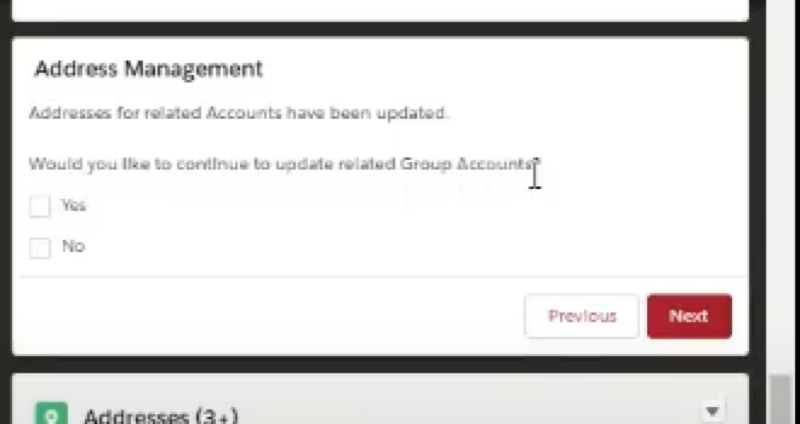

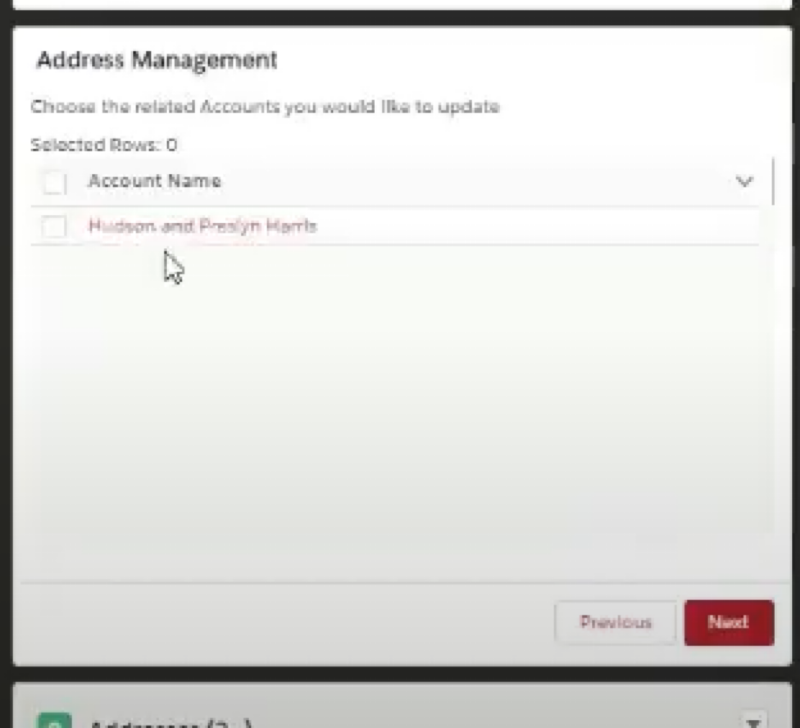

Adding a new address is a similar process, but it goes a level deeper by asking if you would also like to add the new address to related group accounts.

Select Yes, and the related accounts appear, giving you the option to select which related accounts to assign the new address to. Select Finish to add the new address to this account.

This saves time since the user can update several records in a single session, rather than opening and updating each individual record. For this example it could potentially be four to update!

The third choice in Address Management is inactivating an address.

Select Next and choose the address to invalidate from the list of addresses. Select Finish to label the address as invalid.

The financial advisor can now send compliance letters to the correct address. If a client sells a home, a compliance letter can be sent to both the “sold” address and the new address to verify the address change. Letters can be generated through a different system, such as Conga, and sent to a print queue. A task can also be assigned to the person responsible for mailing the letters once they’ve been generated and printed.

Flow Automation can be added to Financial Services Cloud to make compliance a little easier. Things like keeping track of addresses can be time consuming, but automation can help. ShellBlack consultants can add automation to your Financial Services Cloud to help save you some time, while helping to keep you compliant. Contact ShellBlack today to learn how we can help.

Author Credit:

Lisa Kilmer CFP© Salesforce Consultant at ShellBlack.com

Content Contributed by:

Christina Harris Director of Data Services at ShellBlack.com